|

|

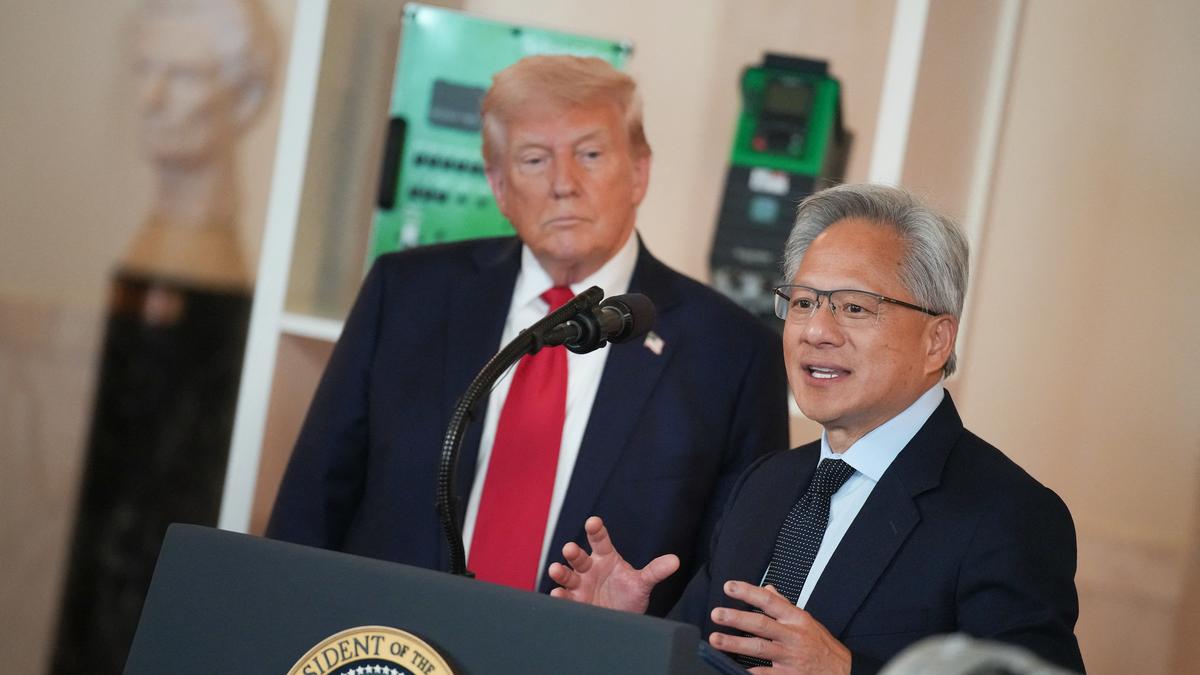

The article details the controversy surrounding former President Donald Trump's deal with Nvidia, which involves the U.S. government receiving a cut of the company's sales in exchange for resuming exports of banned AI chips to China. This move has raised significant concerns among lawmakers, analysts, and legal experts who believe it could undermine national security and set a dangerous precedent for future trade negotiations. Historically, the U.S. has maintained a strict policy of controlling the export of sensitive technologies on national security grounds, with decisions considered non-negotiable. This approach aimed to prevent adversaries from gaining access to technologies that could enhance their military or technological capabilities, regardless of the potential financial losses for American companies. Trump's deal, however, appears to deviate from this long-standing policy, suggesting that national security concerns can be negotiated for a price. The prospect of allowing Nvidia to sell its H20 chips to China, with the U.S. government receiving a 15% cut of the sales, has drawn sharp criticism from both Republican and Democratic lawmakers. Representative John Moolenaar, chair of the House Select Committee on China, warned that such a deal could incentivize the government to grant licenses for the sale of technology that would enhance China's AI capabilities. Representative Raja Krishnamoorthi echoed this concern, stating that putting a price on security concerns signals to China and U.S. allies that American national security principles are negotiable. The Trump administration, however, has defended the deal by arguing that the national security risks of resuming H20 sales are minimal because the chip was already widely available in China. Commerce Secretary Howard Lutnick described the H20 as Nvidia's "fourth-best chip," suggesting that its sale to China would not significantly enhance their technological capabilities. Furthermore, the administration argued that it is in the U.S.'s interest for Chinese firms to continue using American technology. However, critics argue that even if the H20 chip is not the most advanced, allowing its sale to China still provides them with access to valuable technology and resources that could be used to advance their AI development. Moreover, the deal raises broader concerns about the precedent it sets for future trade negotiations and the potential for other countries to demand similar concessions from the U.S. The legality of Trump's move is also questionable. The U.S. Constitution prohibits Congress from levying taxes and duties on articles exported from any state. Trade lawyer Jeremy Iloulian questioned whether the revenue-sharing agreement could be considered an "export tax" or some other form of payment, emphasizing that there has never been a consideration of how much companies need to pay to receive an export license. Kyle Handley, a professor at the University of California San Diego School of Global Policy and Strategy, described the deal as "an export tax," regardless of what the government calls it. Nvidia has responded to the controversy by stating that it follows the rules set by the U.S. government for its participation in worldwide markets and hopes that export control rules will allow America to compete in China and worldwide. AMD has also stated that it adheres to all U.S. export controls but did not directly address the revenue-sharing agreement. The deal with Nvidia is not an isolated incident in Trump's interventions in corporate decision-making. He has previously pressured executives to invest in American manufacturing and demanded the resignation of Intel's CEO over his ties to Chinese companies. These actions demonstrate a willingness to use presidential power to influence corporate behavior in ways that are not always aligned with traditional U.S. economic policy. Sarah Kreps, a professor at Cornell University, noted that "everything now in this administration seems negotiable in ways that were not the case before," suggesting that the Nvidia deal is indicative of a broader shift in U.S. trade policy. The potential consequences of this shift are far-reaching and could impact the U.S.'s relationships with its allies, its ability to control the export of sensitive technologies, and its overall national security. Equities analysts have also expressed concerns about the potential impact of the deal on chipmakers' margins and the precedent it sets for Washington to tax critical U.S. exports. Bernstein analysts expect the deal to cut gross margins on China-bound processors by 5 to 15 percentage points, which would shave about a point from Nvidia and AMD's overall margins. Hendi Susanto, a portfolio manager at Gabelli, noted that companies selling other strategic products to China may wonder if the remittance model could apply to their industries, which could be a burden or a lifeline to preserve market access. The Nvidia deal raises a number of important questions about the future of U.S. trade policy, the role of the government in corporate decision-making, and the balance between economic interests and national security concerns. Its long-term implications remain to be seen, but it is clear that it has already sparked significant controversy and debate.