|

|

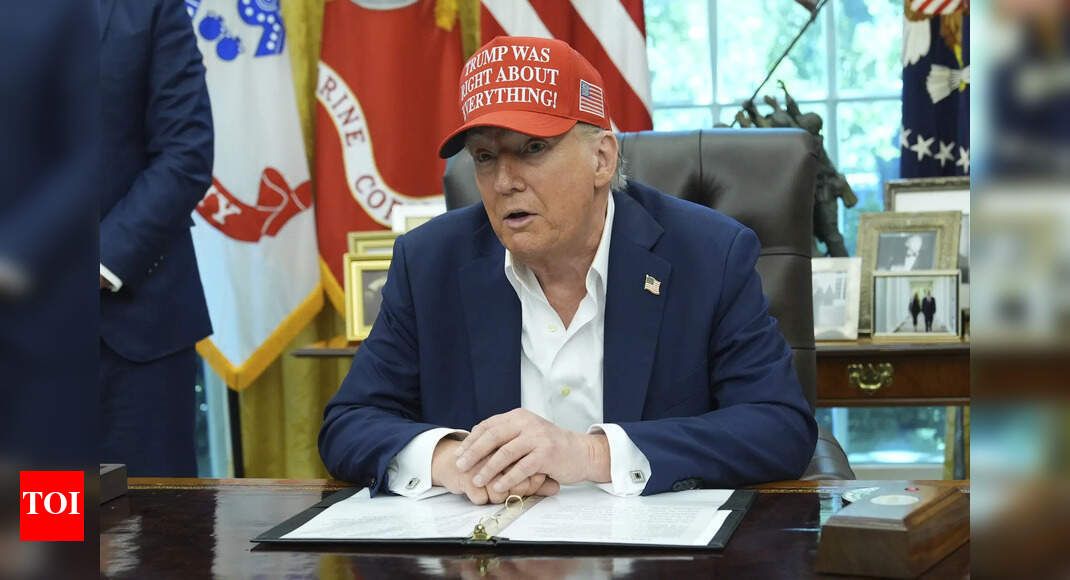

The article details a complex trade dispute between the United States and China, focusing on the exchange of rare-earth magnets and Boeing airplane parts. Former President Donald Trump, in a statement to reporters, threatened to impose tariffs of 200% on Chinese goods if China restricted the export of rare-earth magnets. These magnets are crucial components in various industries, including automotive, electronics, and renewable energy, giving China significant leverage in trade negotiations due to its dominant position in the global supply chain. China controls approximately 90% of the world's rare-earth magnet production and refining processes, making the US heavily reliant on these materials. Trump also revealed that the US had withheld Boeing parts, preventing 200 Chinese planes from flying, as a countermeasure to China not supplying magnets. This revelation underscores the strategic importance of aerospace in the ongoing trade negotiations, especially considering Boeing's potential deal to sell up to 500 aircraft to China. The surge in China's rare-earth magnet exports to the US, with shipments increasing by 660% in June and continuing to rise in July, seemingly triggered Trump's warning. This increase may have been an attempt by China to preemptively supply the US market before potential trade restrictions were imposed. The analyst Henry Wang dismissed Trump's remarks as a bluff, suggesting that the focus should be on the implementation of existing trade agreements. He stated that Trump often exaggerates threats of tariffs and punishment, but the real progress lies in both countries adhering to the agreed-upon terms. The current temporary trade truce, which includes eased controls on Chinese rare-earth exports and relaxed American tech restrictions, is set to expire in mid-November. This impending deadline adds pressure to the ongoing negotiations, with the fate of the trade truce hinging on continued engagement between the two nations. Senior Chinese trade negotiator Li Chenggang is reportedly traveling to Washington for meetings with US Trade Representative Jamieson Greer and other senior officials, indicating a willingness to continue negotiations and seek a resolution to the trade dispute. The article highlights the interconnectedness of various industries and the strategic importance of raw materials in global trade relations. It also emphasizes the role of political rhetoric and negotiation tactics in shaping trade policy. The potential consequences of a trade war between the US and China could be far-reaching, impacting not only the economies of both nations but also the global economy. The article effectively captures the key aspects of this complex trade dispute, providing insights into the motivations and strategies of both sides.

The context surrounding Trump's threat of tariffs must be understood within the broader landscape of US-China trade relations during his presidency. The imposition and threat of tariffs were frequently used as negotiation tactics by the Trump administration, aiming to address what they perceived as unfair trade practices and intellectual property theft by China. The specific focus on rare-earth magnets highlights the strategic vulnerability of the US economy due to its reliance on China for these critical materials. Rare-earth elements are essential for various high-tech applications, including electric vehicles, wind turbines, and military equipment, making their supply a matter of national security. The withholding of Boeing parts as leverage represents a significant escalation in the trade dispute. Boeing, a major US exporter, has long relied on China as a key market for its aircraft. Using this commercial relationship as a bargaining chip demonstrates the willingness of the Trump administration to employ unconventional tactics to achieve its trade objectives. The analyst's assessment that Trump's remarks are a bluff should be viewed with caution. While it is true that Trump often used strong rhetoric in negotiations, he also demonstrated a willingness to follow through on his threats, as evidenced by the imposition of tariffs on billions of dollars worth of Chinese goods. Therefore, it is essential to consider the potential for escalation and the real-world consequences of the trade dispute. The upcoming November deadline for the trade truce adds further urgency to the negotiations. The outcome of these negotiations will likely determine the future of US-China trade relations for the foreseeable future. A failure to reach an agreement could lead to a renewed trade war, with significant economic and geopolitical implications. The reported meeting between senior trade negotiators from both countries suggests a willingness to engage in dialogue and seek a mutually acceptable resolution. However, the deep-seated differences between the two nations and the complex issues at stake make a successful outcome far from certain.

Furthermore, the long-term implications of this specific dispute over rare-earth magnets and Boeing parts extend beyond the immediate trade negotiations. The US is actively seeking to diversify its supply chains for rare-earth elements, reducing its reliance on China. This includes investing in domestic mining and processing capabilities and working with allies to develop alternative sources of supply. The European Union and other countries are also taking similar steps to ensure the security of their rare-earth supplies. The China's dominance in the rare-earth market is not solely based on its reserves but also on its expertise in refining and processing these materials. Building up these capabilities in other countries will require significant investment and time. The Boeing situation highlights the potential vulnerability of US companies to retaliatory measures by China. China could potentially shift its orders to Airbus or other aircraft manufacturers, impacting Boeing's revenue and market share. The US government may need to consider providing support to Boeing to mitigate the risks associated with the trade dispute. The analyst's comments about focusing on the implementation of existing trade agreements are crucial. Ensuring compliance with agreed-upon terms is essential for building trust and stability in the trade relationship. However, verification and enforcement mechanisms are often challenging, and disputes over compliance can easily escalate. The potential for a technological decoupling between the US and China is also a significant concern. The US has imposed restrictions on the export of certain technologies to China, and China is investing heavily in developing its own indigenous technologies. This decoupling could lead to increased fragmentation of the global economy and reduced innovation. In conclusion, the trade dispute between the US and China is a multifaceted and complex issue with significant economic, political, and technological implications. The specific case of rare-earth magnets and Boeing parts illustrates the strategic vulnerabilities and potential risks associated with this dispute. A resolution will require careful negotiation, mutual understanding, and a willingness to compromise on both sides. The long-term consequences of this dispute will shape the future of global trade and international relations.