|

|

The Reserve Bank of India's (RBI) Monetary Policy Committee (MPC) has once again decided to hold the repo rate steady at 5.5 percent, a decision that reflects the central bank's continued cautious approach to managing inflation and fostering economic growth. This marks a continuation of the RBI's policy stance, which aims to strike a delicate balance between controlling inflationary pressures and supporting economic recovery. The MPC, composed of six members, unanimously agreed on this decision, signaling a consensus view on the current macroeconomic landscape. The decision to maintain the neutral policy stance further reinforces the RBI's commitment to closely monitoring economic developments and calibrating its policy response accordingly. The significance of the repo rate lies in its role as the benchmark interest rate at which commercial banks borrow money from the RBI. This rate subsequently influences the interest rates that banks charge their customers on loans, thereby impacting borrowing costs for businesses and consumers alike. By keeping the repo rate unchanged, the RBI aims to provide a degree of stability in the financial system and prevent any sharp fluctuations in interest rates that could disrupt economic activity. The decision is particularly noteworthy in the context of the ongoing global economic uncertainties, which continue to pose challenges for policymakers worldwide. Geopolitical tensions, supply chain disruptions, and volatile commodity prices have all contributed to a complex and unpredictable economic environment. In light of these uncertainties, the RBI's decision to maintain a steady course reflects a prudent approach to managing risks and preserving economic stability. Furthermore, the MPC's decision to lower the inflation projection for FY26 to 3.1 percent indicates a growing confidence in the outlook for price stability. While the RBI remains vigilant about inflationary pressures, the revised forecast suggests that the central bank expects inflation to gradually moderate over the medium term. This downward revision is likely based on a combination of factors, including improved supply conditions, a moderation in global commodity prices, and the impact of past monetary policy tightening measures. The RBI's commitment to price stability is enshrined in its mandate, and the central bank has consistently emphasized its determination to keep inflation within its target range. Achieving this goal is crucial for fostering sustainable economic growth and maintaining the purchasing power of consumers. At the same time, the RBI has also acknowledged the importance of supporting economic growth, particularly in the aftermath of the COVID-19 pandemic. The Indian economy has shown remarkable resilience in recent years, but it still faces challenges such as weak global demand and uneven recovery across different sectors. In this context, the RBI's decision to maintain its forecast for real gross domestic product (GDP) growth for the current year at 6.5 percent signals its confidence in the economy's underlying strength. This growth projection is based on expectations of continued strength in domestic demand, supported by government spending on infrastructure and other initiatives. The RBI has also highlighted the importance of structural reforms to enhance the economy's long-term growth potential. These reforms include measures to improve productivity, reduce regulatory burdens, and promote investment in key sectors such as manufacturing and infrastructure. In addition to its monetary policy decisions, the RBI also plays a crucial role in regulating and supervising the financial system. The central bank has been actively working to strengthen the stability and resilience of the banking sector, promote financial inclusion, and enhance the efficiency of payment systems. These efforts are essential for ensuring that the financial system can effectively support economic growth and development. The RBI's decision to keep the repo rate unchanged and maintain its growth forecast underscores its commitment to a balanced approach to policymaking, one that prioritizes both price stability and economic growth. The central bank's proactive and data-driven approach to monetary policy has been instrumental in navigating the complex challenges facing the Indian economy. In the future, the RBI will continue to closely monitor economic developments and stand ready to adjust its policy stance as needed to ensure that the economy remains on a sustainable growth path. The dynamic nature of the global economy requires constant vigilance and adaptability, and the RBI has demonstrated its ability to respond effectively to changing circumstances. Ultimately, the RBI's goal is to create a stable and predictable economic environment that fosters investment, innovation, and job creation, thereby improving the living standards of all Indians.

The RBI's stance on the repo rate and inflation forecasts has ripple effects across various sectors of the Indian economy. For businesses, a stable repo rate translates to predictable borrowing costs, allowing them to plan investments and expansions with greater certainty. Small and medium-sized enterprises (SMEs), which often rely on bank loans for their working capital needs, benefit particularly from stable interest rates. Lower inflation projections are also welcome news for businesses, as they reduce the risk of rising input costs and allow for more accurate financial planning. For consumers, the RBI's decisions impact their borrowing costs for housing, vehicles, and other big-ticket items. Stable or lower interest rates can make it more affordable to purchase these items, boosting consumer spending and driving economic growth. Lower inflation also benefits consumers by preserving their purchasing power and preventing a decline in real incomes. The financial markets also react to the RBI's policy announcements. Stock markets tend to respond positively to signals of economic stability and growth, while bond markets are sensitive to changes in interest rate expectations. The RBI's communication about its policy stance plays a crucial role in shaping market sentiment and influencing investment decisions. The government's fiscal policy and the RBI's monetary policy work in tandem to achieve macroeconomic stability. The government's spending and taxation policies can influence aggregate demand, while the RBI's interest rate policies can influence borrowing costs and investment decisions. Effective coordination between the government and the RBI is essential for achieving sustainable economic growth and managing inflationary pressures. The global economic environment also plays a significant role in shaping the RBI's policy decisions. Factors such as global commodity prices, exchange rates, and interest rate policies in other countries can all impact the Indian economy. The RBI must carefully monitor these external factors and adjust its policy response accordingly. The RBI's decision-making process is data-driven, relying on a wide range of economic indicators to assess the state of the economy. These indicators include inflation rates, GDP growth, unemployment rates, and trade balances. The RBI's economists and analysts conduct extensive research and analysis to inform the MPC's decisions. The MPC's deliberations are confidential, but the RBI releases a statement after each meeting explaining the rationale behind its policy decisions. This transparency helps to build confidence in the RBI's decision-making process and promotes accountability. The RBI's role extends beyond monetary policy to include regulation and supervision of the financial system. The RBI sets prudential norms for banks, monitors their financial health, and takes corrective action when necessary. The RBI also promotes financial inclusion by encouraging banks to expand their reach to underserved populations. The RBI's efforts to strengthen the financial system are crucial for ensuring its stability and resilience, which in turn supports economic growth. The RBI also plays a key role in managing the country's foreign exchange reserves. These reserves provide a buffer against external shocks and help to maintain the stability of the Indian rupee. The RBI intervenes in the foreign exchange market when necessary to manage volatility and prevent excessive fluctuations in the rupee's value. The RBI's actions in the foreign exchange market are guided by the objective of maintaining financial stability and promoting orderly market conditions. The RBI's long-term goal is to create a stable and prosperous economy that benefits all Indians. The central bank's commitment to price stability, economic growth, and financial stability is essential for achieving this goal. The RBI's proactive and data-driven approach to policymaking has been instrumental in navigating the complex challenges facing the Indian economy. In the future, the RBI will continue to adapt its policies to meet the evolving needs of the economy and ensure its long-term sustainability.

Looking ahead, several factors will influence the RBI's monetary policy decisions. The global economic outlook remains uncertain, with concerns about a potential recession in some major economies and ongoing geopolitical tensions. These factors could put downward pressure on global demand and impact India's exports. Domestically, the RBI will be closely monitoring inflation rates, particularly food prices, which can be volatile. Supply chain disruptions and adverse weather conditions can also contribute to inflationary pressures. The RBI will also be assessing the impact of its past monetary policy tightening measures on economic growth. The full effects of interest rate hikes typically take several quarters to materialize, so the RBI will need to carefully evaluate the data before making further policy adjustments. The government's fiscal policy will also play a crucial role in shaping the RBI's policy decisions. Large government borrowings can put upward pressure on interest rates, while increased government spending can stimulate economic growth. The RBI will need to coordinate its monetary policy with the government's fiscal policy to achieve macroeconomic stability. The RBI's communication strategy will also be important in guiding market expectations and influencing investor behavior. Clear and transparent communication about the RBI's policy intentions can help to reduce uncertainty and promote confidence in the financial system. The RBI will also need to continue to adapt its regulatory framework to address new challenges and opportunities in the financial sector. The rise of fintech companies and the increasing use of digital payment systems are transforming the financial landscape, and the RBI will need to ensure that these innovations are properly regulated and supervised. The RBI will also need to continue to promote financial inclusion by expanding access to banking services and encouraging the use of digital payment methods. Financial inclusion is essential for promoting economic growth and reducing inequality. The RBI's long-term vision is to create a modern and efficient financial system that supports the country's economic development. The central bank's commitment to innovation, transparency, and financial stability will be crucial for achieving this vision. The RBI's role as a steward of the Indian economy is more important than ever in today's rapidly changing world. The central bank's proactive and data-driven approach to policymaking will be essential for navigating the challenges and opportunities that lie ahead. The RBI's ultimate goal is to create a stable and prosperous economy that benefits all Indians, and the central bank is committed to working tirelessly to achieve this goal. The effectiveness of the RBI's policies depends not only on its own actions but also on the cooperation and support of other stakeholders, including the government, the financial sector, and the public. By working together, these stakeholders can create a more resilient and sustainable economy that benefits all. The RBI's journey towards achieving its goals is an ongoing process, and the central bank will continue to learn and adapt as it faces new challenges and opportunities. The RBI's commitment to excellence and its dedication to serving the nation are the driving forces behind its success.

The intersection of global economic forces and domestic policy responses creates a complex tapestry that the RBI must navigate with precision. The interplay between international trade, capital flows, and exchange rates significantly influences the Indian economy, requiring the RBI to remain vigilant in monitoring these external factors. Furthermore, the evolving geopolitical landscape introduces uncertainties that can impact commodity prices and supply chains, necessitating a flexible and adaptable approach to monetary policy. Domestically, the RBI's policies must consider the unique characteristics of the Indian economy, including its diverse regional variations, its large informal sector, and its dependence on agriculture. These factors create challenges in accurately forecasting economic trends and implementing effective policy responses. The RBI also plays a crucial role in promoting financial literacy and consumer protection. Educating the public about financial products and services can empower individuals to make informed decisions and avoid financial pitfalls. Strengthening consumer protection mechanisms can help to prevent fraud and abuse in the financial sector. The RBI's efforts to promote financial literacy and consumer protection are essential for building a more inclusive and equitable financial system. The RBI's success depends on its ability to attract and retain talented professionals. The central bank offers a challenging and rewarding career path for economists, financial analysts, and other experts. The RBI's commitment to professional development and its emphasis on meritocracy are essential for building a highly skilled and motivated workforce. The RBI also fosters a culture of research and innovation, encouraging its staff to explore new ideas and develop innovative solutions to economic challenges. The RBI's research publications and conferences contribute to the global body of knowledge on monetary policy and financial stability. The RBI's international collaborations also play a crucial role in shaping global economic policy. The RBI participates in international forums such as the International Monetary Fund (IMF) and the Bank for International Settlements (BIS), contributing to discussions on global economic issues and sharing its expertise with other central banks. The RBI's engagement in international collaborations helps to promote a more stable and prosperous global economy. The RBI's history is a testament to its resilience and adaptability. The central bank has weathered numerous economic crises and has consistently played a stabilizing role in the Indian economy. The RBI's legacy of sound monetary policy and effective financial regulation has helped to build confidence in the Indian economy and attract foreign investment. The RBI's future success will depend on its ability to uphold these traditions while also adapting to the changing needs of the economy. The RBI's commitment to excellence and its dedication to serving the nation will continue to guide its actions in the years to come. The RBI's role as a guardian of the Indian economy is a sacred trust, and the central bank is committed to fulfilling this responsibility with integrity and professionalism. The RBI's unwavering dedication to the well-being of the Indian people is the foundation of its success and the source of its strength.

The relationship between the Reserve Bank of India (RBI) and the government is a critical aspect of India's economic governance. While the RBI operates independently in formulating and implementing monetary policy, it also works closely with the government to achieve shared economic objectives. This delicate balance of autonomy and collaboration is essential for ensuring that monetary and fiscal policies are aligned and mutually reinforcing. The RBI's independence is enshrined in the Reserve Bank of India Act, which grants the central bank the authority to set interest rates, regulate the banking system, and manage the country's foreign exchange reserves. This independence is crucial for insulating monetary policy from political pressures and ensuring that decisions are made in the best interests of the economy as a whole. However, the RBI also recognizes the importance of coordinating its policies with the government to achieve broader economic goals, such as promoting economic growth, reducing poverty, and improving infrastructure. The RBI Governor regularly consults with the Finance Minister and other government officials to discuss economic conditions and policy priorities. The RBI also participates in various government committees and task forces to provide its expertise on economic matters. The government, in turn, respects the RBI's independence and refrains from interfering in its day-to-day operations. However, the government also has the power to appoint the RBI Governor and Deputy Governors, which gives it some degree of influence over the central bank's leadership. The relationship between the RBI and the government has evolved over time, reflecting changes in the Indian economy and the global economic environment. In recent years, there has been increasing emphasis on the importance of communication and transparency in the relationship between the two institutions. The RBI regularly publishes its policy decisions and provides detailed explanations of its rationale, which helps to build trust and confidence in the central bank's actions. The government also communicates its economic policies clearly and transparently, which helps to reduce uncertainty and promote coordination between monetary and fiscal policies. The success of the RBI-government relationship depends on mutual respect, trust, and a shared commitment to the well-being of the Indian economy. When the two institutions work together effectively, they can create a stable and prosperous economic environment that benefits all Indians. The RBI and the government face numerous challenges in managing the Indian economy, including inflation, unemployment, and external shocks. However, by working together in a spirit of cooperation and collaboration, they can overcome these challenges and build a brighter future for the country. The RBI-government relationship is a vital component of India's economic governance framework, and its continued success is essential for ensuring the long-term prosperity of the nation. The importance of this relationship cannot be overstated, as it plays a crucial role in shaping the economic destiny of India.

The Reserve Bank of India (RBI) plays a multifaceted role in the Indian economy, extending beyond its core function of monetary policy formulation. It serves as the regulator and supervisor of the banking system, the manager of the country's foreign exchange reserves, and the banker to the government. Each of these roles is vital for ensuring the stability and efficiency of the Indian financial system. As the regulator and supervisor of the banking system, the RBI sets prudential norms for banks, monitors their financial health, and takes corrective action when necessary. This oversight is crucial for preventing banking crises and protecting depositors' money. The RBI also promotes financial inclusion by encouraging banks to expand their reach to underserved populations and offer affordable financial services. As the manager of the country's foreign exchange reserves, the RBI intervenes in the foreign exchange market to maintain the stability of the Indian rupee. This intervention is necessary to prevent excessive volatility in the rupee's value, which can disrupt trade and investment flows. The RBI also uses its foreign exchange reserves to meet the country's external debt obligations and finance imports. As the banker to the government, the RBI provides banking services to the central and state governments. It manages the government's accounts, processes its payments, and advises it on financial matters. The RBI also acts as the government's debt manager, issuing government bonds and managing the government's debt portfolio. The RBI's multifaceted role requires it to possess a wide range of expertise and skills. Its staff includes economists, financial analysts, bankers, and lawyers, all of whom work together to ensure the smooth functioning of the Indian financial system. The RBI also collaborates with other regulatory agencies, such as the Securities and Exchange Board of India (SEBI) and the Insurance Regulatory and Development Authority of India (IRDAI), to coordinate its regulatory efforts and prevent regulatory arbitrage. The RBI's commitment to excellence and its dedication to serving the nation are essential for maintaining its credibility and effectiveness. The central bank's actions have a significant impact on the lives of all Indians, and it takes its responsibilities seriously. The RBI's future success will depend on its ability to adapt to the changing needs of the Indian economy and the global financial system. The central bank must continue to innovate and improve its processes to remain at the forefront of monetary policy and financial regulation. The RBI's legacy of sound policymaking and effective regulation has helped to build a strong and resilient Indian financial system, and it is committed to continuing this legacy in the years to come. The RBI's unwavering dedication to the well-being of the Indian people is the foundation of its success and the source of its strength.

The communication strategy of the Reserve Bank of India (RBI) is a vital tool for shaping market expectations, influencing investor behavior, and maintaining public confidence in the central bank's policies. Effective communication is essential for ensuring that the RBI's monetary policy decisions are understood and accepted by the public, the financial markets, and the government. The RBI communicates its policy decisions through a variety of channels, including press releases, speeches, publications, and social media. Press releases are the primary means of announcing monetary policy decisions, such as changes in interest rates or reserve requirements. These releases provide a concise explanation of the RBI's rationale for its decisions and their likely impact on the economy. Speeches by the RBI Governor and other senior officials provide a more detailed explanation of the central bank's views on the economy and its policy outlook. These speeches are often delivered at conferences, seminars, and other public forums. The RBI also publishes a variety of reports and publications on the Indian economy, including its annual report, its quarterly monetary policy report, and its monthly bulletin. These publications provide detailed analysis of economic trends and the RBI's policy responses. In recent years, the RBI has also embraced social media as a means of communicating with the public. The RBI's Twitter account provides timely updates on its policy decisions and its views on the economy. The RBI's communication strategy is guided by several principles, including transparency, clarity, consistency, and credibility. Transparency requires the RBI to be open and honest about its policy decisions and its views on the economy. Clarity requires the RBI to communicate its messages in a clear and concise manner, avoiding technical jargon and complex language. Consistency requires the RBI to maintain a consistent message over time, avoiding sudden shifts in policy or communication. Credibility requires the RBI to be perceived as a reliable and trustworthy source of information. The RBI's communication strategy has evolved over time, reflecting changes in the Indian economy and the global financial system. In recent years, there has been increasing emphasis on the importance of forward guidance, which involves providing clear signals about the RBI's future policy intentions. Forward guidance can help to shape market expectations and reduce uncertainty about the future course of monetary policy. The success of the RBI's communication strategy depends on its ability to adapt to the changing needs of the economy and the financial markets. The central bank must continue to innovate and improve its communication channels to ensure that its messages are heard and understood by all stakeholders. The RBI's commitment to transparency, clarity, consistency, and credibility is essential for maintaining public confidence in its policies and ensuring the stability of the Indian financial system. The RBI's communication strategy is a vital tool for achieving its monetary policy objectives and promoting economic growth and stability.

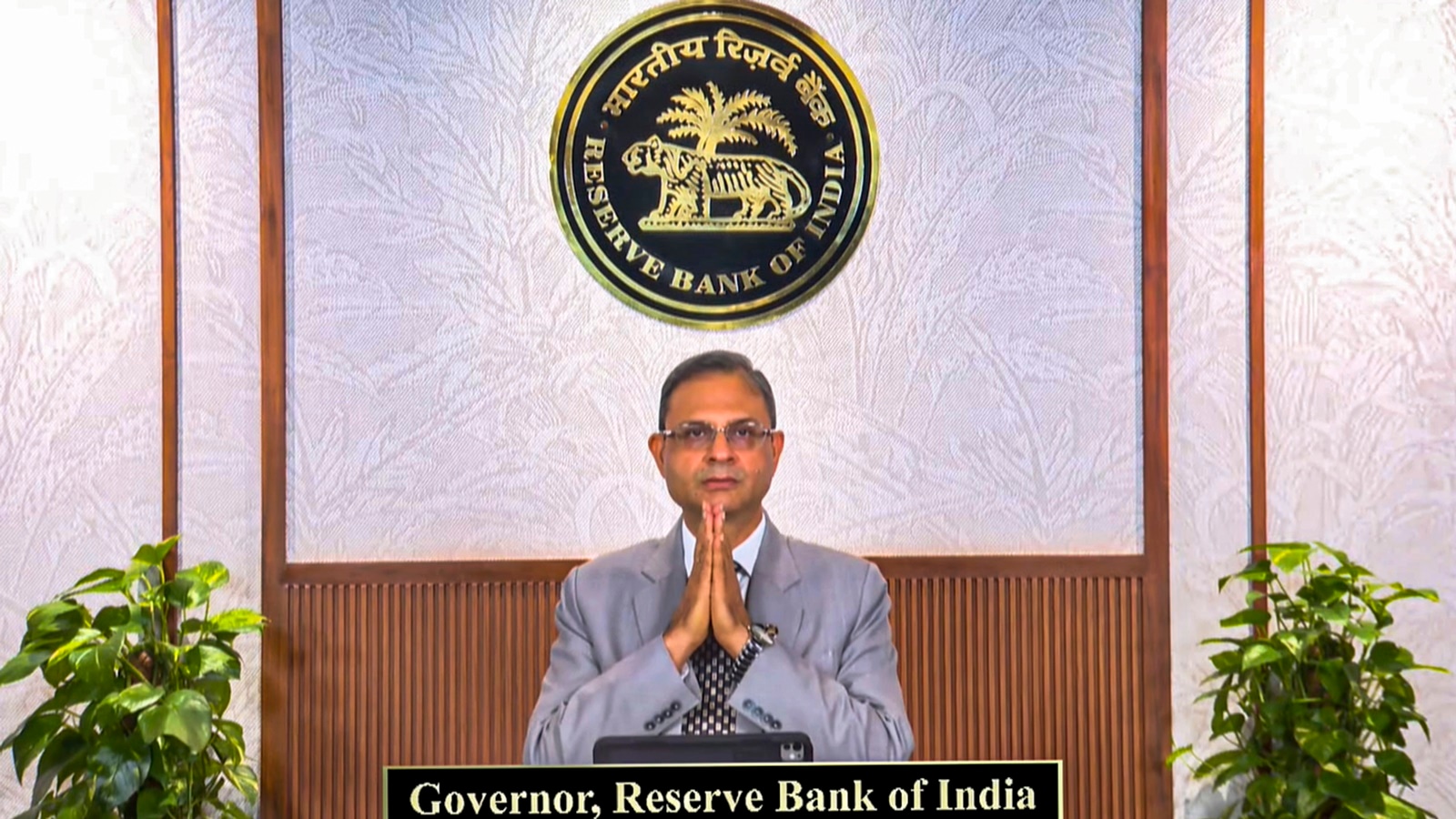

Source: RBI keeps repo rate unchanged at 5.5%; lowers FY26 CPI inflation forecast to 3.1%