|

|

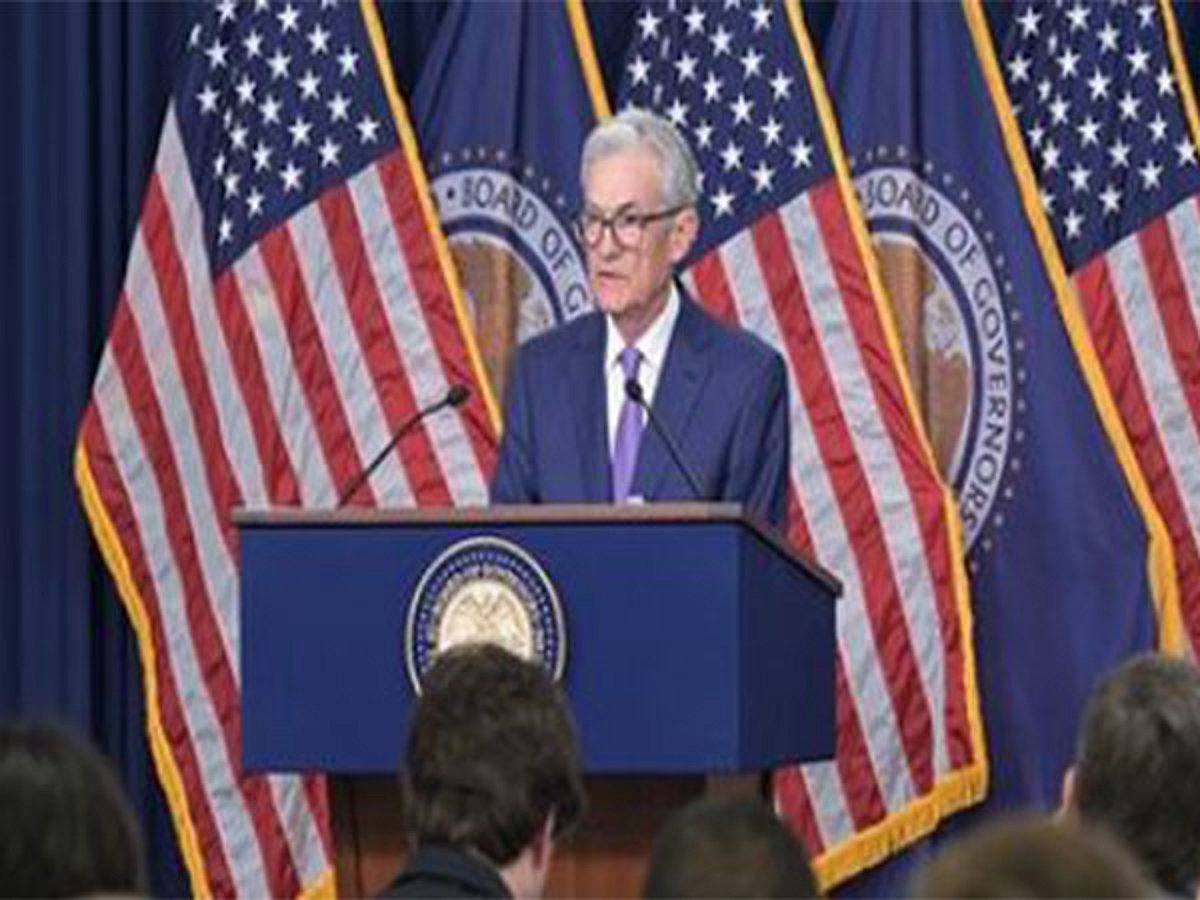

Jerome Powell's recent signals regarding potential interest rate cuts by the US Federal Reserve have sent ripples across global financial markets, particularly impacting emerging economies like India. Powell's Jackson Hole speech alluded to a possible easing of monetary policy in response to a softening job market and persistent inflationary pressures stemming from tariff-related uncertainties. This subtle indication was enough to fuel speculation among investors, with market expectations for a September rate cut significantly increasing. The immediate reaction witnessed a decline in US bond yields and a weakening of the US dollar as the markets factored in the probability of a more accommodative monetary policy stance by the Federal Reserve. The anticipated impact of this shift is expected to reverberate through the Indian financial landscape, primarily affecting the Indian rupee and the Indian government bond market.

The Indian rupee is predicted to open stronger against the US dollar on the first trading day following Powell's pronouncements. A weaker dollar and lower US Treasury yields generally create a more favorable environment for emerging market currencies, as these assets become relatively more attractive to investors seeking higher returns. Market analysts anticipate that the USD/INR pair will likely experience downward pressure, with immediate support levels around 87.00–86.90. Conversely, resistance levels are projected to be in the range of 87.50–87.70. However, the Reserve Bank of India (RBI) is widely expected to intervene in the currency market to manage volatility and prevent excessively sharp movements in the rupee. This intervention is likely to temper any significant intraday gains, resulting in a modest firming of the rupee rather than a substantial appreciation.

The influence of global events and risk sentiment cannot be overlooked. Should there be any adverse global news or a resurgence in dollar strength, the USD/INR pair could potentially retrace its steps and move back towards the 87.50–87.70 resistance level. This underscores the inherent vulnerability of emerging market currencies to external shocks and the importance of monitoring global economic developments closely. Moreover, the article highlights the anticipated positive impact on Indian government bonds. Following the decline in US Treasury yields, Indian government bonds are expected to experience upward pressure, resulting in a fall in yields. The benchmark 10-year G-Sec, which closed around 6.55% on Friday, could potentially ease by 3–6 basis points in early trading, possibly testing levels near 6.50%. This reflects the inverse relationship between bond yields and bond prices, where a decrease in yields corresponds to an increase in bond prices. The overall scenario suggests a favorable short-term outlook for the Indian financial markets, driven by expectations of a more dovish monetary policy stance by the US Federal Reserve.

Beyond the immediate impact on the rupee and government bonds, Powell's rate cut hint raises broader questions about the long-term implications for the Indian economy. Lower interest rates in the US could potentially lead to increased capital inflows into India, boosting investment and economic growth. However, excessive capital inflows could also create inflationary pressures and lead to asset bubbles. The RBI would need to carefully manage these potential risks to ensure sustainable economic growth and financial stability. Furthermore, a weaker dollar could make Indian exports more competitive in the global market, benefiting export-oriented industries. On the other hand, it could also make imports more expensive, potentially increasing input costs for businesses that rely on imported raw materials. The net effect on the Indian economy would depend on a variety of factors, including the magnitude of the rate cuts, the global economic environment, and the policy responses of the Indian government and the RBI.

The potential impact on Indian equity markets is also significant. Lower interest rates typically boost equity valuations as they make borrowing cheaper for companies and increase the attractiveness of stocks relative to bonds. However, the impact on specific sectors would vary depending on their sensitivity to interest rates and the overall economic outlook. For example, interest-rate sensitive sectors like banking and real estate could benefit from lower borrowing costs, while sectors that are heavily reliant on exports could benefit from a weaker rupee. Overall, Powell's rate cut hint has created a more optimistic outlook for the Indian financial markets, but it is important to recognize that there are also potential risks and challenges that need to be carefully managed. The Indian government and the RBI would need to work together to ensure that the benefits of lower interest rates are maximized while mitigating the potential negative consequences.

Furthermore, the situation underscores the interconnectedness of global financial markets and the vulnerability of emerging economies to external shocks. The actions of the US Federal Reserve, the world's most influential central bank, have a profound impact on financial conditions in countries around the world. This highlights the importance of sound macroeconomic policies and effective risk management in emerging economies to navigate the complexities of the global financial system. The RBI's role in managing volatility in the currency market is crucial to prevent excessive fluctuations that could disrupt trade and investment. The central bank's ability to intervene effectively depends on its foreign exchange reserves and its credibility in the eyes of investors.

In conclusion, Jerome Powell's hint of potential interest rate cuts by the US Federal Reserve has triggered a series of anticipated effects on the Indian financial markets, including a stronger rupee, lower government bond yields, and potentially positive impacts on equity valuations. However, the Reserve Bank of India is expected to play a critical role in managing volatility and ensuring that the benefits of lower interest rates are realized without creating excessive inflation or financial instability. The situation also serves as a reminder of the interconnectedness of global financial markets and the importance of sound macroeconomic policies in emerging economies. The future trajectory of the Indian economy will depend on a complex interplay of factors, including the magnitude of the rate cuts, the global economic environment, and the policy responses of the Indian government and the RBI. Careful monitoring of these developments is essential for investors, policymakers, and businesses alike.

The article also implicitly highlights the ongoing debate about the effectiveness of monetary policy in stimulating economic growth. While lower interest rates can encourage borrowing and investment, they may not be sufficient to address structural issues such as infrastructure bottlenecks, regulatory hurdles, and skill shortages. These challenges require a comprehensive set of policy reforms to unlock the full potential of the Indian economy. Furthermore, the article touches upon the risks of relying too heavily on monetary policy to manage economic fluctuations. Over-reliance on interest rate adjustments can lead to unintended consequences, such as asset bubbles and excessive risk-taking. A more balanced approach that combines monetary policy with fiscal policy and structural reforms is needed to achieve sustainable and inclusive growth.

Finally, the analysis presented in the article underscores the importance of understanding the nuances of financial markets and the interplay of various economic factors. Market participants need to carefully assess the information available to them and make informed decisions based on their risk tolerance and investment objectives. The article provides valuable insights into the potential impacts of Powell's rate cut hint on the Indian financial markets, but it is important to remember that economic forecasts are subject to uncertainty and unforeseen events. A disciplined and prudent approach to investing is essential to navigate the complexities of the financial world and achieve long-term financial success.

The anticipation of Federal Reserve rate cuts also impacts international trade dynamics. A weaker dollar, resulting from the anticipated rate cuts, makes U.S. exports less expensive for foreign buyers, potentially increasing the demand for American goods and services. Conversely, it makes imports into the U.S. more expensive, which could reduce the trade deficit. For India, this situation presents both opportunities and challenges. Increased demand for U.S. goods may indirectly impact Indian exporters who compete with American products in the global market. However, it can also open up new avenues for collaboration and partnerships in various sectors. Furthermore, the anticipated rate cuts could lead to a global search for yield, as investors seek higher returns in a low-interest-rate environment. This could attract foreign investment into India, boosting the country's capital markets and supporting economic growth. However, it is crucial for the Indian government and the RBI to carefully manage these capital flows to prevent excessive volatility and asset bubbles.

Source: Powell’s rate cut hint: Likely impact on Indian markets, rupee