|

|

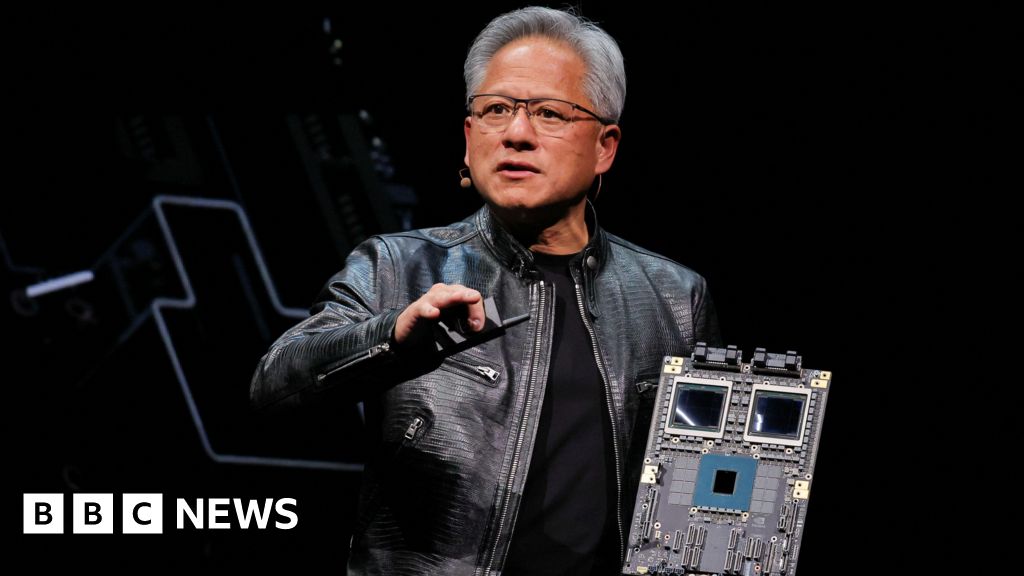

The article details an unprecedented agreement between chip giants Nvidia and AMD and the U.S. government, wherein the companies will pay 15% of their revenues from specific chip sales in China to the U.S. government. This arrangement is tied to securing export licenses to China, highlighting the complexities and costs associated with accessing the Chinese market amidst escalating tech trade tensions. Nvidia will pay 15% of H20 chip sales, while AMD will remit 15% of MI308 chip revenue. This development underscores the delicate balance between national security concerns, economic interests, and technological competition between the U.S. and China. The H20 chip was specifically designed for the Chinese market following U.S. export restrictions imposed in 2023, but its sale was subsequently banned. Nvidia's CEO, Jensen Huang, has actively lobbied for the resumption of chip sales in China, emphasizing the company's strategic interest in maintaining a presence in this significant market. The payment arrangement is viewed by some experts as a compromise that doesn't necessarily eliminate national security concerns, as highlighted by Deborah Elms of the Hinrich Foundation. A group of security specialists has expressed concern that Nvidia's H20 chips could be used by the Chinese military, even if sold to civilian companies. The article further mentions a letter to US Commerce Secretary Howard Lutnick where these security specialists outline their concerns. Nvidia's official statement emphasizes the importance of American competitiveness in AI technology. This episode reflects the ongoing efforts to balance economic opportunity with national security imperatives in the context of rapidly advancing technology and geopolitical competition. The arrangement underscores the financial pressure and strategic uncertainty that tech vendors face amid the shifting geopolitical landscape. The relaxation of export controls on rare earth by Beijing and the lifting of restrictions on chip design software firms operating in China also reflect a slight easing of trade tensions. The situation is further complicated by President Trump's focus on pressuring major companies to invest more in the U.S., with Apple and Micron Technology announcing significant investments. The focus on manufacturing in the US, exemplified by Nvidia's plan to build AI servers, is another facet of this complex web of economic and political factors. Furthermore, the controversies surrounding Lip-Bu Tan, the boss of Intel, and his ties to China highlight the scrutiny and suspicion that can arise in the current environment.

The underlying issue at stake is the control of advanced technologies and their potential use in both civilian and military applications. The United States has implemented export controls on powerful chips to prevent China from gaining a technological advantage in areas like artificial intelligence that could pose a threat to national security. However, these restrictions also impact the ability of American companies to compete in the Chinese market, which is a significant source of revenue and growth for the semiconductor industry. The development of the H20 chip specifically for the Chinese market demonstrates the efforts of American companies to circumvent these restrictions while remaining compliant with U.S. regulations. The agreement to pay a percentage of revenues to the U.S. government can be seen as a way for these companies to gain access to the Chinese market while also contributing to U.S. national security efforts. However, critics argue that this arrangement does not adequately address the underlying security concerns and that it may not be effective in preventing the use of these chips by the Chinese military. The article's mention of easing trade tensions provides context for the agreement. The easing of export controls by Beijing and the lifting of restrictions on chip design software firms operating in China, as well as the 90-day truce in tariffs, are attempts to de-escalate the trade war. However, the fundamental issues related to technology transfer, intellectual property protection, and national security remain unresolved. The emphasis on increased investment in the United States reflects a broader strategy to strengthen the domestic economy and reduce reliance on foreign suppliers, particularly in strategic sectors like semiconductor manufacturing. The controversies surrounding Lip-Bu Tan demonstrate the intense scrutiny that companies and individuals face when their activities are perceived to be linked to China, highlighting the sensitivity of the relationship between the two countries.

The long-term implications of this agreement are significant. The financial burden of paying 15% of revenues to the U.S. government will impact the profitability of Nvidia and AMD in the Chinese market. This may incentivize these companies to seek alternative strategies for accessing the Chinese market, such as developing less powerful chips that are not subject to export controls or shifting production to countries outside the U.S. The agreement could also lead to further restrictions on technology exports to China if the U.S. government determines that the current arrangement is not sufficient to address national security concerns. This could escalate tensions between the two countries and further disrupt global supply chains. On the other hand, the agreement could serve as a model for future negotiations between the U.S. and other countries regarding technology trade and national security. It could also encourage other companies to invest more in the United States, as a way to gain favor with the U.S. government and secure access to the domestic market. The impact on the Chinese semiconductor industry is also worth considering. The export controls imposed by the U.S. have spurred China to invest heavily in developing its own domestic semiconductor industry. The restrictions on access to advanced chips from American companies may accelerate these efforts and lead to greater self-sufficiency in the long run. However, it will take time for China to catch up with the technological capabilities of the leading semiconductor companies, and in the meantime, the country will continue to rely on imports of advanced chips. The evolving geopolitical landscape between the US and China significantly influences the landscape of the semiconductor industry, leading companies like Nvidia and AMD to navigate a minefield of regulations and strategic challenges. The unprecedented agreement highlights the complexities and the high price of market access in an era of tech trade tensions.

Source: Nvidia and AMD to pay 15% of China chip sales to US government