|

|

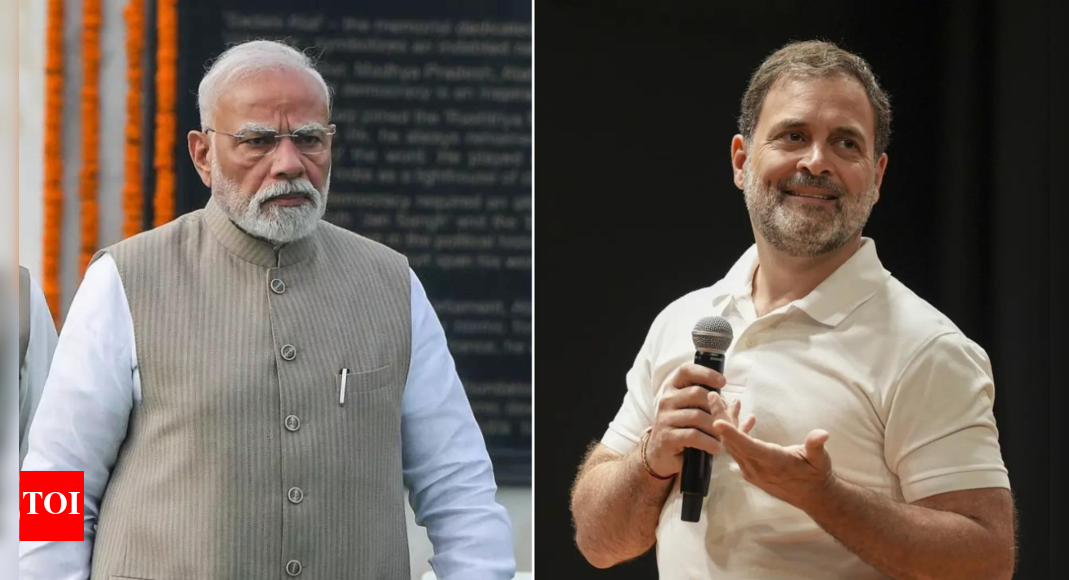

The Goods and Services Tax (GST), implemented in India several years ago, is once again under the spotlight as the central government contemplates significant structural reforms. The proposed changes involve a shift towards a two-slab tax structure, a move that Prime Minister Narendra Modi has publicly touted as a Diwali gift to the nation, aimed at simplifying the tax regime and reducing the burden on daily-use items for the common citizen. However, this announcement has sparked a political firestorm, with the Indian National Congress asserting that the idea is not new but rather a belated adoption of their long-standing policy proposals. The Congress party points to its 2024 election manifesto and previous statements, particularly from Rahul Gandhi dating back to 2018, advocating for a streamlined GST structure. This has led to a contentious debate over the origin and ownership of the reform idea, with both parties vying for credit and attempting to position themselves as the true champions of the people's interests.

The specifics of the proposed GST reform, often referred to as 'GST 2.0', include the reduction of the existing multi-tiered system to just two primary slabs: a 5% rate for essential common-use items and an 18% rate for the majority of other goods and services. This simplification aims to eliminate the current 12% and 28% brackets, streamlining the tax process for businesses and consumers alike. Furthermore, the plan also addresses the compensation cess, with a proposed end date coinciding with the existing March 2026 deadline. One additional element of the reform is the suggestion of a higher 40% levy on 'sin goods' - items such as tobacco and alcohol, which are often subjected to higher taxes due to their perceived negative impact on society. The proposed changes are scheduled for discussion by a group of state finance ministers, marking a crucial step in the process of consultation and consensus-building that is essential for any significant change to the GST framework. The Finance ministers' meeting will be crucial in shaping the final contours of the proposed GST 2.0.

The Congress party, led by figures like Jairam Ramesh, has been vocal in its claim that the government is simply catching up to their policy vision. They highlight Rahul Gandhi's past advocacy for GST reform, including calls for a maximum rate of 18%, as evidence of their proactive stance on the issue. The party argues that the current GST system, which Gandhi famously labelled the 'Gabbar Singh Tax', has become overly complex and burdensome due to the proliferation of different tax rates and exemptions. They have criticized the system for facilitating tax evasion and hindering economic growth. In response to the government's announcement, the Congress has demanded the release of an official discussion paper on GST 2.0, calling for a wider and more informed debate on the future of the tax regime. They believe that a comprehensive public discussion is essential to ensure that any reforms are truly beneficial to the Indian economy and its citizens, and not simply a political exercise.

The political dimension of this debate cannot be ignored. With national elections on the horizon, both the ruling BJP and the opposition Congress are keenly aware of the potential electoral impact of tax reforms. The GST is a highly visible and often controversial issue, affecting businesses and consumers across the country. By claiming ownership of the reform idea, the Congress hopes to portray itself as a forward-thinking and responsive party, in tune with the needs of the people. The BJP, on the other hand, is likely to emphasize its commitment to economic growth and simplification, portraying the reforms as a natural evolution of its policies. The timing of the announcement, framed as a Diwali gift, suggests a deliberate attempt to curry favor with voters ahead of the festive season. The ongoing tussle over GST reform highlights the complex interplay between economic policy and political strategy in India. It remains to be seen whether the proposed changes will ultimately deliver the promised benefits, or whether they will become another battleground in the country's political landscape.

One of the key concerns surrounding the proposed GST reforms is the potential impact on state finances. Under the existing GST system, states are compensated for any revenue losses incurred as a result of the implementation of the tax. The compensation cess, which is levied on certain goods and used to fund these payments, is due to expire in March 2026. The proposed elimination of the 12% and 28% tax brackets could have significant implications for state revenue, particularly for states that rely heavily on these higher tax rates. The state finance ministers who will be discussing the reforms will need to carefully consider the potential impact on their respective budgets and ensure that adequate mechanisms are in place to address any revenue shortfalls. The success of the GST 2.0 hinges on building consensus among the states and addressing their concerns in a transparent and equitable manner. The discussions must consider economic factors, such as inflation, business growth, and consumer spending.

In addition to the political and financial considerations, the technical aspects of implementing the GST reforms will also be crucial. The transition to a two-slab system will require significant adjustments to the IT infrastructure and administrative processes that support the GST. Businesses will need to adapt their accounting systems and pricing strategies to reflect the new tax rates. The government will need to provide clear guidance and support to businesses to ensure a smooth transition. Furthermore, there is a risk that the simplification of the tax structure could create opportunities for tax evasion. The government will need to strengthen its enforcement mechanisms to prevent this from happening. A proper implementation strategy, supported by investments in technology and enforcement, will be required to ensure that the proposed GST reforms achieve their intended objectives of simplifying the tax system and reducing the burden on citizens and businesses. The current IT infrastructure may require significant upgrades and updates to seamlessly support the new two-slab GST structure. Tax authorities will need to implement robust mechanisms to combat tax evasion and ensure compliance with the new regulations.

The debate surrounding GST reform also raises broader questions about the role of taxation in a modern economy. Taxation is not simply a means of raising revenue for the government. It is also a powerful tool for shaping economic behavior and promoting social objectives. The design of the tax system can have a significant impact on investment, employment, and income distribution. In the case of GST, the objective is to create a more efficient and equitable tax system that supports economic growth and development. However, achieving this objective requires careful consideration of the trade-offs between simplicity, fairness, and revenue generation. The ongoing debate over GST reform provides an opportunity to reflect on these fundamental principles and to ensure that the tax system is aligned with the broader goals of society. The Indian economy is constantly evolving, and the tax system must adapt to meet the changing needs of businesses and consumers. Continuous evaluation and refinement of the GST are essential to ensure its effectiveness and relevance.

Ultimately, the success of the proposed GST reforms will depend on the ability of the government to build consensus among stakeholders, address the concerns of states, and implement the changes in a transparent and effective manner. The political posturing and blame game surrounding the reform should not distract from the fundamental goal of creating a more efficient and equitable tax system that benefits all Indians. A collaborative approach, focused on finding common ground and working towards shared objectives, is essential to ensure that the GST fulfills its potential as a catalyst for economic growth and social progress. The GST Council, which includes representatives from the central government and all state governments, plays a critical role in shaping the future of the GST. This council must act with wisdom and foresight to ensure that the GST continues to serve the interests of the Indian economy and its citizens. The long-term benefits of a simplified and efficient GST system are significant, and it is imperative that all stakeholders work together to achieve this goal.

In conclusion, the proposed GST reforms represent a significant opportunity to improve the Indian tax system and promote economic growth. However, the political debate surrounding the reforms highlights the challenges of achieving consensus and implementing complex policy changes in a diverse and democratic society. The government must be willing to engage in constructive dialogue with all stakeholders, address their concerns, and ensure that the reforms are implemented in a fair and transparent manner. Only then can the GST truly fulfill its potential as a tool for economic development and social progress. The Indian economy is on a path of growth, and a well-designed and well-implemented GST system can play a crucial role in accelerating this growth and creating opportunities for all Indians. The focus should remain on the long-term benefits of a simplified and efficient tax system, rather than short-term political gains.

The next phase of GST implementation requires a collaborative approach involving the government, businesses, and citizens. This cooperation is crucial for the success of GST 2.0 and the overall economic progress of India. It's important to prioritize open communication, transparency, and effective problem-solving to ensure a smooth transition and realize the full potential of GST reforms. To foster understanding and trust, the government should actively involve stakeholders in the decision-making process and provide ample opportunities for feedback and suggestions. This inclusive approach will ensure that the final GST structure is well-suited to the needs of all parties involved. By fostering a culture of collaboration, India can build a more resilient and prosperous economy for generations to come.