|

|

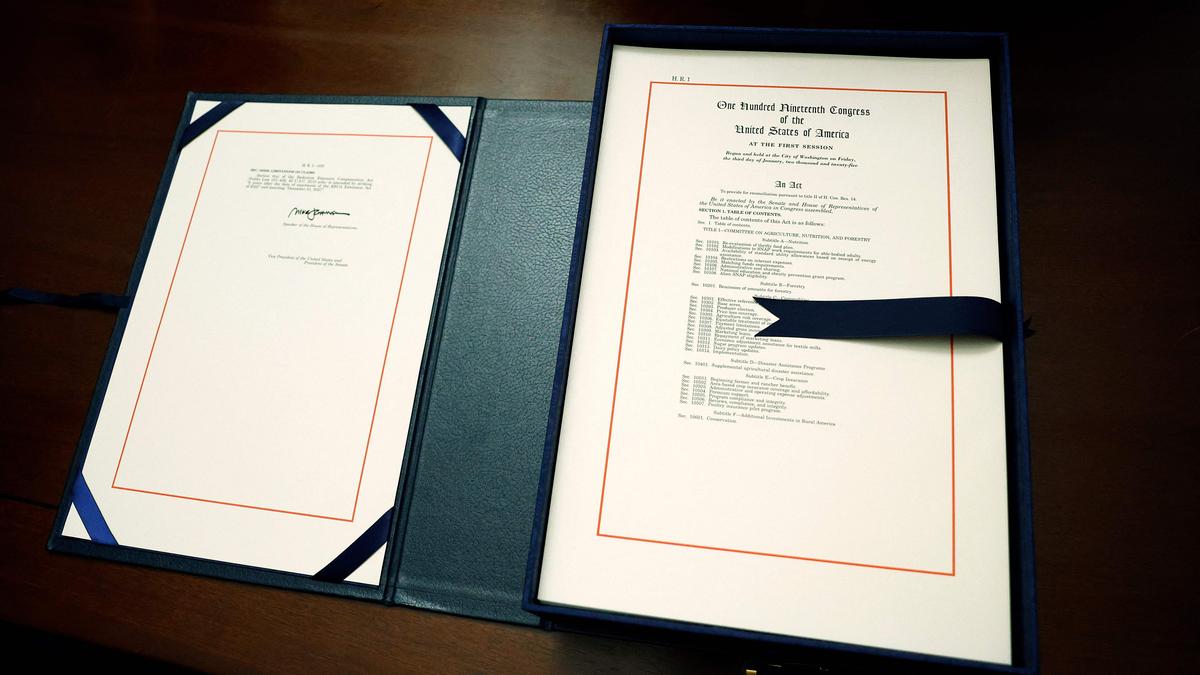

The United States, in a move that could significantly impact global remittance flows, particularly to India, has enacted the “One Big Beautiful Bill,” spearheaded by Donald Trump. This legislation, set to take effect on July 4, 2025, introduces a 1% levy on remittances sent by non-U.S. citizens through specific channels, namely cash, money orders, and cashier's checks. This tax targets a significant portion of the international money transfer market, specifically those transactions originating from non-U.S. citizens residing and working in the United States, encompassing green card holders and individuals on temporary visas such as H-1B and H-2A. The exemption of U.S. citizens from this tax highlights the legislation's intention to primarily impact foreign workers sending money back to their home countries. The rationale behind the bill, though not explicitly stated in the article, could stem from various factors, including a desire to bolster domestic revenue, discourage capital outflow, or incentivize the use of formalized banking systems. However, the potential ramifications for recipient nations like India are substantial and far-reaching. The decision to impose this tax, even at a reduced rate of 1% from the initially proposed 5%, raises important questions about international economic policy and its impact on developing economies that heavily rely on remittance inflows. The article underscores the complexities involved in global financial flows and the sensitivity of remittance-dependent economies to policy changes in major source countries. Furthermore, it highlights the need for a nuanced understanding of the various factors influencing remittance behavior and the potential unintended consequences of policies aimed at regulating these flows.

India, as the world's largest recipient of remittances, stands to be significantly affected by this new U.S. tax. The Global Trade Research Initiative (GTRI) has voiced concerns about the potential loss of billions of dollars in annual foreign currency inflows, a critical source of financial support for countless families across the country. The Reserve Bank of India (RBI) data confirms the U.S. as the largest source of remittances to India, accounting for a substantial 27.7%, equivalent to $32.9 billion, of the total remittances received in 2023-24. This dependence on U.S. remittances makes India particularly vulnerable to any policy changes that affect these inflows. The geographical concentration of remittance dependence further exacerbates the potential impact. States like Kerala, Uttar Pradesh, and Bihar have millions of families that rely on remittances to cover essential expenses such as education, healthcare, and housing. A reduction in these remittances could have a ripple effect, impacting local economies and exacerbating existing socio-economic challenges. The GTRI also anticipates that the reduced supply of U.S. dollars in India's foreign exchange market could exert depreciation pressure on the Indian rupee. This depreciation could lead to increased import costs, potentially fueling inflation and further straining household budgets, especially for those reliant on remittances. The magnitude of the impact on the rupee will depend on the overall reduction in remittances and the RBI's intervention strategy in the foreign exchange market. The central bank's response will be crucial in mitigating the potential adverse effects of the new U.S. tax on the Indian economy.

The bill's provisions offer some relief, albeit limited, to Non-Resident Indians (NRIs). The reduction of the tax rate from the initial 5% to 1% is a positive development, although the impact remains substantial. More importantly, the exemption of remittances made from accounts held in financial institutions and those funded with debit or credit cards issued in the United States provides an avenue for mitigating the tax burden. This exemption incentivizes the use of formal banking channels and electronic payment methods for sending money to India. NRIs who currently send money through cash, money orders, or cashier's checks may choose to switch to electronic transfers to avoid the tax. However, this shift may not be feasible for all NRIs, particularly those who lack access to banking services or prefer traditional remittance methods. Furthermore, the transaction fees associated with electronic transfers could offset some of the benefits of avoiding the 1% tax. The Indian government's response to the new U.S. tax remains uncertain. While a government official acknowledged that the tax would “certainly dent the remittances coming into India,” the government has not yet made a comprehensive assessment of the potential impact. The official also indicated that India has not yet decided whether to approach the U.S. for relief in the matter. A proactive approach from the Indian government, including diplomatic efforts and policy adjustments, could be crucial in mitigating the negative consequences of the U.S. tax on remittances.

The potential policy responses from the Indian government could include negotiating with the U.S. government for exemptions or special treatment for India, promoting the use of formal banking channels for remittances, and strengthening domestic programs aimed at supporting remittance-dependent families. India could also explore alternative sources of foreign currency inflows to reduce its reliance on U.S. remittances. Diversifying the sources of remittances and attracting investments from other countries could help buffer the Indian economy against external shocks. Furthermore, the Indian government could consider offering incentives to NRIs to invest in India, thereby channeling remittances into productive investments. Promoting financial literacy and encouraging NRIs to save and invest a portion of their remittances in India could also contribute to the long-term economic development of the country. The success of these policy responses will depend on the Indian government's ability to effectively coordinate its efforts across various ministries and agencies and to engage with relevant stakeholders, including NRIs, banks, and international organizations. The long-term implications of the U.S. remittance tax extend beyond the immediate financial impact. The tax could potentially discourage migration to the United States, as foreign workers may be less willing to send money back home if they are subject to additional taxes. This could have implications for the U.S. economy, which relies on foreign workers in various sectors. Furthermore, the tax could incentivize undocumented migration, as individuals may seek to avoid the tax by sending money through informal channels. The broader economic and social consequences of the U.S. remittance tax warrant careful consideration, and policymakers should be mindful of the potential unintended consequences of the policy.

The global implications of the U.S. remittance tax are also noteworthy. While India is the largest recipient of remittances, other countries, including Mexico, China, the Philippines, France, Pakistan, and Bangladesh, also receive significant remittance inflows. These countries could also be affected by the U.S. tax, although the impact may vary depending on the volume of remittances received from the United States and the specific characteristics of each country's economy. The U.S. remittance tax could set a precedent for other countries to impose similar taxes on remittances sent abroad by foreign workers. This could lead to a global trend of increasing taxation on remittances, which could have negative consequences for developing countries that rely on these inflows. International organizations, such as the World Bank and the International Monetary Fund, could play a role in advocating for policies that promote remittance flows and minimize the negative impact of taxation. These organizations could also provide technical assistance to developing countries to help them manage the potential impact of remittance taxes. The U.S. remittance tax highlights the interconnectedness of the global economy and the importance of international cooperation in addressing economic challenges. The long-term sustainability of remittance flows depends on a stable and predictable policy environment that encourages migration, investment, and economic growth. Policymakers should strive to create such an environment by fostering international dialogue, promoting fair trade practices, and investing in education and infrastructure. The challenges and opportunities associated with remittances require a multi-faceted approach that takes into account the perspectives of all stakeholders, including governments, migrants, and recipient communities.

In conclusion, the U.S. remittance tax presents a significant challenge for India and other remittance-dependent countries. The potential loss of billions of dollars in foreign currency inflows could have a detrimental impact on the Indian economy and the livelihoods of millions of families. While the exemption of electronic transfers offers some relief, the overall impact of the tax is likely to be negative. The Indian government needs to proactively address the challenges posed by the U.S. tax by engaging in diplomatic efforts, promoting the use of formal banking channels, and strengthening domestic programs aimed at supporting remittance-dependent families. Furthermore, India needs to diversify its sources of foreign currency inflows and promote investments from NRIs to reduce its reliance on U.S. remittances. The long-term sustainability of remittance flows depends on a stable and predictable policy environment that encourages migration, investment, and economic growth. Policymakers should strive to create such an environment by fostering international dialogue, promoting fair trade practices, and investing in education and infrastructure. The U.S. remittance tax serves as a reminder of the importance of international cooperation in addressing economic challenges and the need for policies that promote inclusive and sustainable development. By working together, governments, international organizations, and civil society can ensure that remittances continue to play a vital role in supporting families and communities around the world. The complexities surrounding this issue necessitate careful consideration and a comprehensive strategy to mitigate potential negative consequences and ensure the continued flow of vital financial resources to those who depend on them.

Source: One Big Beautiful Bill: US passes 1% foreign remittance tax, how will it impact Indians?