|

|

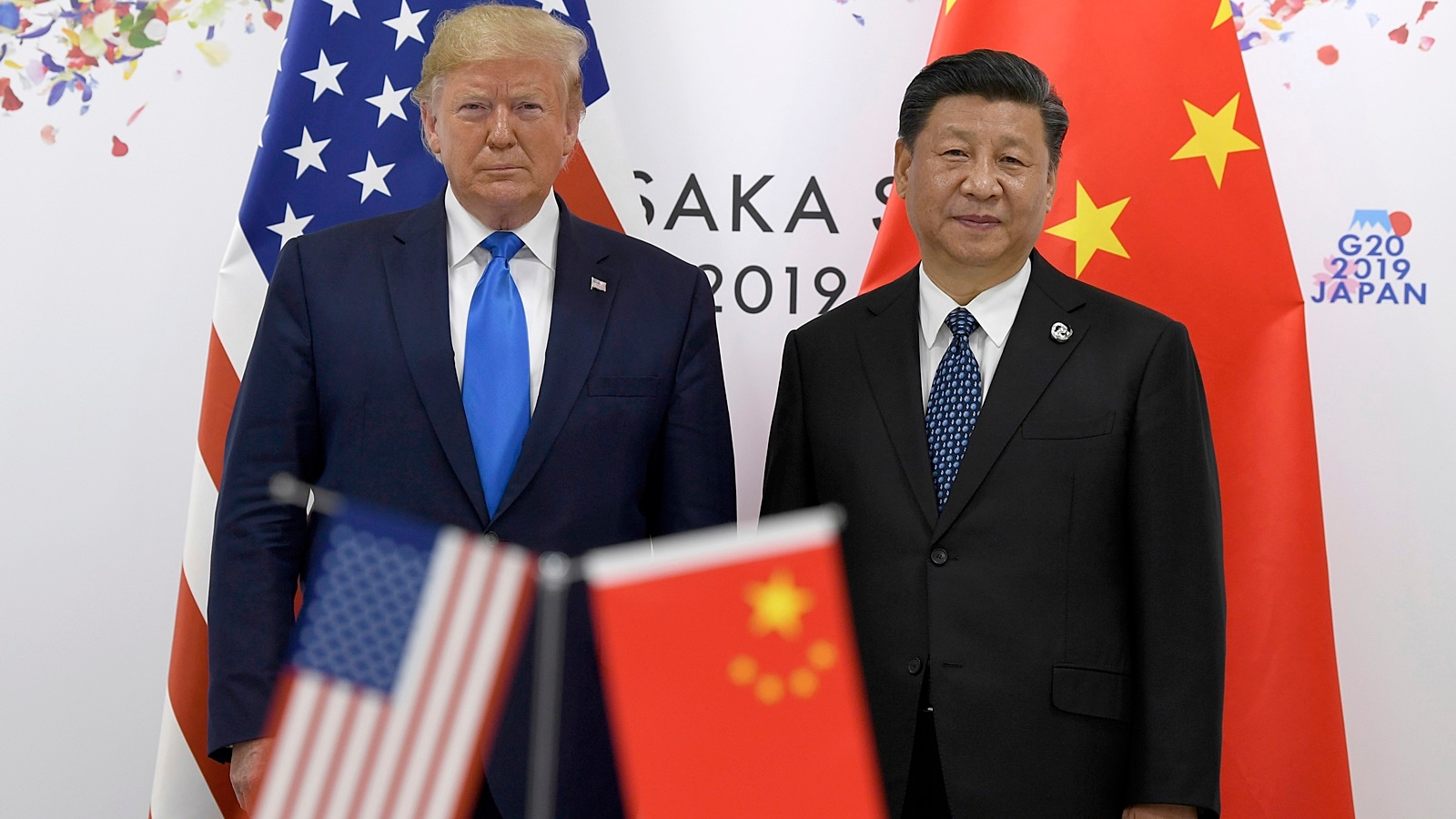

The article details a new trade agreement between the United States and China, brokered under President Donald Trump, focusing primarily on securing access to Chinese rare earth minerals and magnets for US industries. The agreement, still pending final approval from Chinese President Xi Jinping, involves a revision of tariffs, bringing the total tariffs on Chinese imports to 55 percent. This development is particularly significant given the US reliance on rare earth elements for various critical sectors, including automotive, electronics, and defense. China's dominance in the global rare earth market had previously allowed it to restrict supplies, creating a near-crisis situation for the US auto industry, which was on the brink of pausing production due to a shortage of magnets used in windshields and door mechanisms. The agreement addresses this vulnerability by ensuring a consistent supply of these crucial materials from China. Furthermore, the deal also includes provisions for easing access for Chinese students to study at US universities, a concession from the US side. The negotiation process, which spanned two days at Lancaster House, ultimately led to a framework that aims to revive the trade truce between the two nations and roll back China’s export restrictions on rare earths. However, it's important to note that the agreement primarily focuses on this specific issue and offers limited resolutions to broader trade issues that exist between the US and China. Trump emphasized the reciprocal nature of the agreement, stating that the US would also provide China with what was agreed to, including access for Chinese students to US colleges and universities. This aspect reflects the ongoing efforts to maintain a balance of interests in the complex trade relationship between the two economic powerhouses. The agreement follows a period of heightened trade tensions between the US and China, characterized by escalating tariffs and restrictions on critical mineral exports. The US had previously responded to China's restrictions by halting shipments of semiconductor design software, aircraft, and other high-tech goods to China, further exacerbating the situation. The current agreement, however, signals a potential de-escalation and a willingness to find common ground on specific areas of mutual concern. The 55 percent tariff announced by Trump is higher than the 30 percent agreed upon in the Geneva truce last month. A White House official clarified that this includes a 10 percent baseline "reciprocal" tariff, a 20 percent tariff for fentanyl trafficking, and a 25 percent tariff reflecting pre-existing tariffs. China would charge a 10 percent tariff on US imports, according to the official. This complex tariff structure highlights the multifaceted nature of the trade negotiations and the various factors that contribute to the overall tariff rates. The agreement has been described by US Secretary of Commerce Howard Lutnick as adding "meat on the bones" of the earlier Geneva accord, suggesting that it provides more concrete details and mechanisms for implementation. Lutnick emphasized that the deal still awaits final sign-off from both Trump and Xi, highlighting the remaining uncertainty surrounding its full implementation. In an interview with CNBC, Lutnick affirmed that the tariff levels on China would not change and that China has agreed to examine how it can do more business with the US. He also indicated that trade deals with other countries can be expected starting next week, suggesting that the US is actively pursuing broader trade strategies beyond the agreement with China.

The significance of this trade agreement lies in several key aspects. Firstly, it addresses a critical vulnerability in the US supply chain by securing access to rare earth minerals and magnets, which are essential for various industries. China's dominance in the rare earth market has long been a concern for the US, as it gives China significant leverage in trade negotiations and the potential to disrupt US industries. By ensuring a consistent supply of these materials, the agreement reduces the risk of supply chain disruptions and enhances the competitiveness of US industries. Secondly, the agreement represents a potential de-escalation of trade tensions between the US and China. While it does not resolve all outstanding trade issues, it demonstrates a willingness on both sides to find common ground and address specific areas of mutual concern. This can help to improve the overall atmosphere of the trade relationship and create opportunities for further negotiations on other issues. Thirdly, the agreement highlights the importance of international trade and cooperation in addressing global challenges. The global economy is highly interconnected, and disruptions in one region can have significant consequences for other regions. By working together to resolve trade disputes and promote fair trade practices, countries can foster greater economic stability and prosperity. Fourthly, the agreement showcases the complexities involved in international trade negotiations. The tariff structure, the concessions made by both sides, and the need for final approval from both leaders all demonstrate the intricate nature of these negotiations. It also underscores the importance of having skilled negotiators who can effectively represent their country's interests and find mutually beneficial solutions. The impact of this trade agreement on the US economy is likely to be multifaceted. On the one hand, it could lead to lower costs for US industries that rely on rare earth minerals and magnets, making them more competitive in the global market. It could also create jobs in these industries as companies expand their production capacity. On the other hand, the higher tariffs on Chinese imports could lead to higher prices for consumers, as companies pass on the costs to their customers. It could also lead to retaliatory measures from China, which could harm US exports. Overall, the net impact of the agreement on the US economy is likely to depend on a variety of factors, including the specific details of the agreement, the response of US industries and consumers, and the overall state of the global economy.

The strategic implications of securing rare earth access are considerable. Rare earth elements are crucial components in a wide array of technologies, including electric vehicles, wind turbines, smartphones, and military equipment. Control over the supply of these elements grants significant geopolitical power. By ensuring a reliable supply of rare earths from China, the US reduces its dependence on other potentially unstable sources and strengthens its national security. This also enables the US to compete more effectively in the global market for these advanced technologies. Furthermore, the agreement may prompt the US to invest more heavily in developing its own domestic rare earth mining and processing capabilities. While the agreement with China provides a short-term solution to the rare earth supply issue, a long-term strategy should involve diversifying sources and building domestic capacity to reduce dependence on any single country. This would involve investing in research and development, streamlining permitting processes, and providing incentives for domestic production. The agreement also underscores the importance of international cooperation in addressing global supply chain challenges. The COVID-19 pandemic exposed vulnerabilities in global supply chains, highlighting the need for greater resilience and diversification. By working with allies and partners to build more secure and diversified supply chains, countries can reduce their dependence on potentially unreliable sources and enhance their overall economic security. In conclusion, the US-China trade agreement focused on rare earth minerals and tariffs represents a significant development in the complex relationship between the two countries. While it addresses a critical vulnerability in the US supply chain and offers a potential de-escalation of trade tensions, it also highlights the ongoing challenges and complexities of international trade negotiations. The long-term impact of the agreement will depend on a variety of factors, including the specific details of its implementation, the response of US industries and consumers, and the overall state of the global economy. Ultimately, the agreement underscores the importance of international cooperation, diversification of supply chains, and strategic investment in domestic capabilities to ensure long-term economic security and prosperity. The focus now shifts to the final approval by Presidents Trump and Xi, and the subsequent implementation of the agreement's provisions. The world watches to see if this can become a foundational pillar upon which a more stable and predictable US-China trade relationship can be built, benefitting both nations and the global economy at large.

Source: US secures Chinese rare earths in ‘done deal’ as Trump revises tariffs to 55%