|

|

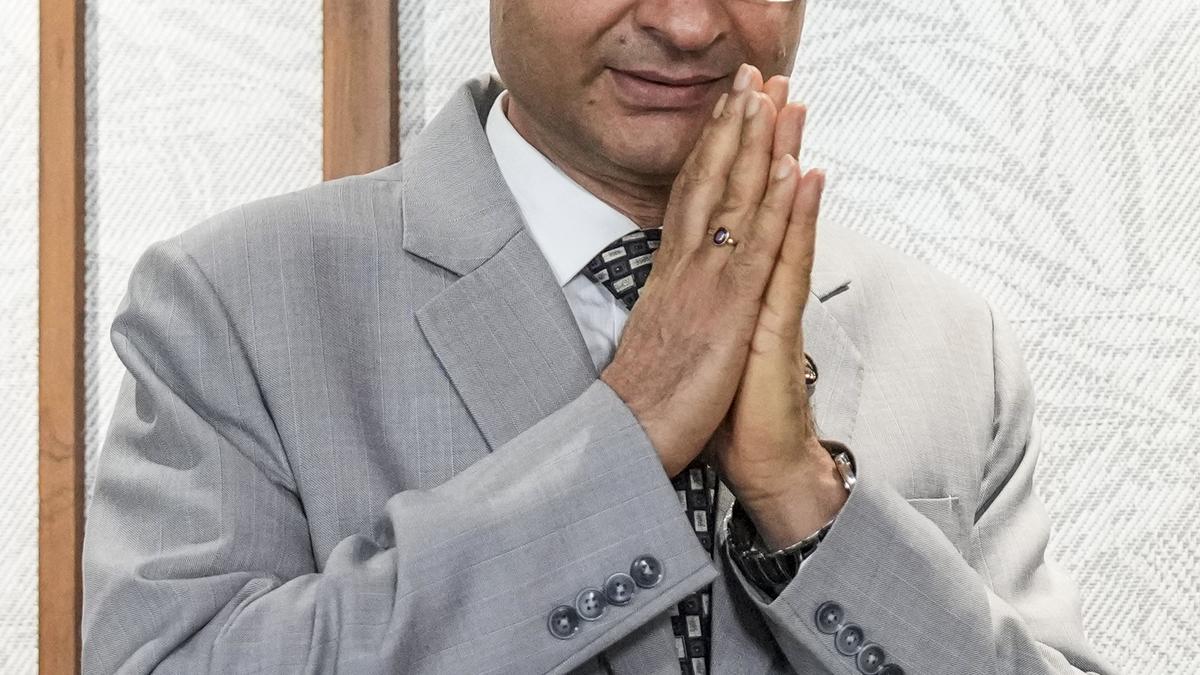

The global economic landscape in mid-2025, as reflected in the minutes of the Monetary Policy Committee (MPC) meeting of the Reserve Bank of India (RBI), presents a complex and precarious picture. The statements from MPC members, particularly Sanjay Malhotra and Poonam Gupta, highlight the delicate balancing act between supporting economic growth and maintaining price stability in the face of significant global uncertainties. Malhotra's assessment of the global economic situation as “fragile and fluid” underscores the challenges confronting policymakers. He points to recurrent geopolitical flare-ups and the reshaping of the global trade order as key factors contributing to this uncertain outlook. The combination of near-term uncertainties and a medium-term outlook that is “overcast” creates a difficult environment for investment and economic expansion. Malhotra's observation that global growth is on a weak footing, coupled with the slow pace of receding inflation, further complicates the policy response. The MPC's consideration of monetary policy options reflects the constraints imposed by this challenging environment. After having reduced policy rates by 100 basis points in quick succession since February 2025, the MPC is acutely aware that its capacity to further stimulate growth through rate cuts is limited. Malhotra's statement that monetary policy would be left with “very limited space to support growth” in the prevailing growth-inflation scenario is a stark acknowledgement of these constraints. Given this limited space, Malhotra advocates for a shift in the MPC's stance from accommodative to neutral. This change in stance signals a recognition that further rate cuts may not be the most effective tool for supporting growth, particularly in light of the potential for inflation to rebound. A neutral stance would allow the MPC to assess incoming data and evolving global uncertainties before making further policy adjustments. The shift also reflects a concern that continued accommodation could exacerbate inflationary pressures, undermining the objective of price stability. Malhotra's emphasis on the need for growth-supportive policies, despite the limited scope for monetary easing, suggests that other policy levers may need to be deployed to stimulate economic activity. These could include fiscal measures, structural reforms, or efforts to improve the investment climate. The MPC's decision to maintain the growth forecast at 6.5%, the same as the previous year's outturn, indicates a cautious optimism about the Indian economy's resilience. However, this optimism is tempered by the recognition that heightened global uncertainties could dampen investment decisions by businesses, necessitating proactive policy interventions. Malhotra's vote for a 50 basis point rate cut, despite his overall cautious stance, reflects his assessment that the sharp reduction in inflation over the past few months warrants some monetary easing. The decline in inflation from 6.2% in October 2024 to 3.2% in April 2025, along with the projected reduction in annual average inflation from 4.6% to 3.7%, provides some room for the MPC to provide modest support to growth without jeopardizing price stability.

Poonam Gupta's perspective, as another MPC member and Deputy Governor, reinforces the sense of urgency and the need for decisive action. Her statement highlights the debate within the MPC regarding the optimal approach to rate cuts. While acknowledging that a case could be made for two consecutive rate cuts of 25 basis points each in the current and next policy cycle, Gupta argues for a more front-loaded approach. Her vote for a policy rate cut of 50 basis points in the current meeting reflects her belief that this would provide greater policy certainty, faster transmission of monetary policy, and a more effective counter to the challenges emanating from the global economy. Gupta's rationale for a front-loaded rate cut is based on the idea that a larger, more immediate reduction would have a more significant impact on borrowing costs and economic activity. This approach could also signal the MPC's commitment to supporting growth, boosting business and consumer confidence. The argument for faster transmission of monetary policy is particularly relevant in the context of global uncertainties. A more decisive rate cut could quickly filter through the financial system, lowering interest rates on loans and other financial instruments, and stimulating investment and consumption. Gupta's support for a change in stance from accommodative to neutral, similar to Malhotra's, underscores the consensus within the MPC regarding the need for a more data-dependent and cautious approach to monetary policy. She emphasizes that any further actions should be contingent upon incoming data and the evolving global uncertainties. This approach would allow the MPC to respond flexibly to changes in the economic environment, avoiding the risk of overreacting to short-term fluctuations or being locked into a predetermined policy path. The statements from Malhotra and Gupta reflect a broader trend among central banks worldwide towards greater caution and data dependence in monetary policy decision-making. The heightened uncertainties in the global economy, including geopolitical risks, trade tensions, and the potential for financial instability, have made it more difficult to predict the impact of policy interventions. As a result, central banks are increasingly relying on real-time data and careful analysis of economic indicators to guide their policy decisions.

The divergence of opinion within the MPC is further exemplified by Sugato Bhattacharya, the external MPC member who voted for a smaller rate cut of 25 basis points. Bhattacharya's rationale highlights the inherent complexities and trade-offs involved in monetary policy decisions. While acknowledging the prevailing uncertainty stemming from external developments, Bhattacharya emphasizes the resilience of current growth impulses. He points to the role of RBI's liquidity infusion and other measures in supporting economic activity, particularly through lower money market and short-term interest rates, which have reduced banks' cost of funds. Bhattacharya's perspective underscores the importance of considering the broader financial conditions and the effectiveness of various policy tools. His statement that RBI's assurance of continuing large durable liquidity support is likely to have a more dominant effect on further transmission compared to a deep cut in the policy rate reflects a belief that liquidity management can play a crucial role in supporting economic activity, particularly in a context of uncertainty. Bhattacharya's vote for a smaller rate cut reflects a more cautious approach to policy easing. He argues that a measured and cautious progress is more appropriate at this time, given the prevailing uncertainties. This approach would allow the MPC to carefully assess the impact of previous policy interventions and avoid the risk of overstimulating the economy or exacerbating inflationary pressures. Bhattacharya's emphasis on liquidity management also highlights the importance of considering the broader financial system and the role of banks in transmitting monetary policy signals. By ensuring adequate liquidity in the banking system, the RBI can help to lower borrowing costs and support credit growth, which can in turn stimulate investment and consumption. The differing views within the MPC, as reflected in the statements of Malhotra, Gupta, and Bhattacharya, highlight the inherent challenges of monetary policy decision-making in a complex and uncertain global environment. The MPC must carefully weigh the risks and benefits of various policy options, considering the potential impact on economic growth, inflation, and financial stability. The shift in stance from accommodative to neutral, advocated by Malhotra and Gupta, reflects a broader recognition that monetary policy alone cannot solve all of the challenges facing the Indian economy. Other policy levers, such as fiscal measures and structural reforms, will be needed to support sustainable and inclusive growth. The minutes of the MPC meeting provide valuable insights into the policy-making process and the challenges confronting the RBI in its efforts to navigate the uncertain global economic landscape. The MPC's commitment to data-dependent decision-making and its willingness to adapt its policy stance in response to evolving economic conditions are essential for ensuring that monetary policy remains effective in supporting sustainable and inclusive growth.

In conclusion, the MPC minutes paint a picture of an Indian economy grappling with significant global headwinds while simultaneously managing domestic inflationary pressures. The decision to shift towards a neutral stance signals a pragmatic recognition of the limitations of aggressive monetary easing in the face of complex and multifaceted challenges. The MPC members' diverse perspectives, ranging from advocating for a more front-loaded rate cut to emphasizing the importance of liquidity management, underscore the inherent complexities and trade-offs involved in monetary policy formulation. The overall message conveyed is one of cautious optimism, tempered by a keen awareness of the uncertainties that lie ahead. The reliance on data-driven decision-making and a willingness to adapt policy responses as new information emerges will be crucial for navigating the turbulent global economic landscape and ensuring sustained and balanced growth for India. The MPC's deliberations highlight the need for a holistic approach to economic management, encompassing not only monetary policy but also fiscal measures, structural reforms, and efforts to enhance the investment climate. Only through a coordinated and comprehensive policy strategy can India effectively address the challenges posed by the global economic environment and unlock its full potential for growth and development. The emphasis on maintaining price stability, while simultaneously supporting economic growth, reflects the MPC's commitment to fostering a stable and predictable macroeconomic environment that encourages investment, innovation, and job creation. The MPC's ongoing monitoring of global developments and its responsiveness to changing economic conditions will be essential for safeguarding India's economic resilience and ensuring its continued progress on the path of sustainable and inclusive growth. The frank and open exchange of views among MPC members, as evidenced by the minutes of the meeting, demonstrates the robustness of the policy-making process and the commitment to informed and evidence-based decision-making. This transparency and accountability are crucial for building public trust and ensuring that monetary policy serves the best interests of the Indian economy and its citizens. The future trajectory of the Indian economy will depend not only on the effectiveness of monetary policy but also on the implementation of sound fiscal policies, the progress of structural reforms, and the resilience of the global economy. The MPC's role in monitoring these developments and adapting its policy stance accordingly will be paramount in navigating the challenges and opportunities that lie ahead. The ultimate goal of monetary policy is to create a stable and conducive environment for economic growth, job creation, and improved living standards for all Indians. The MPC's commitment to this goal, as reflected in its deliberations and decisions, is essential for ensuring a prosperous and sustainable future for India.