|

|

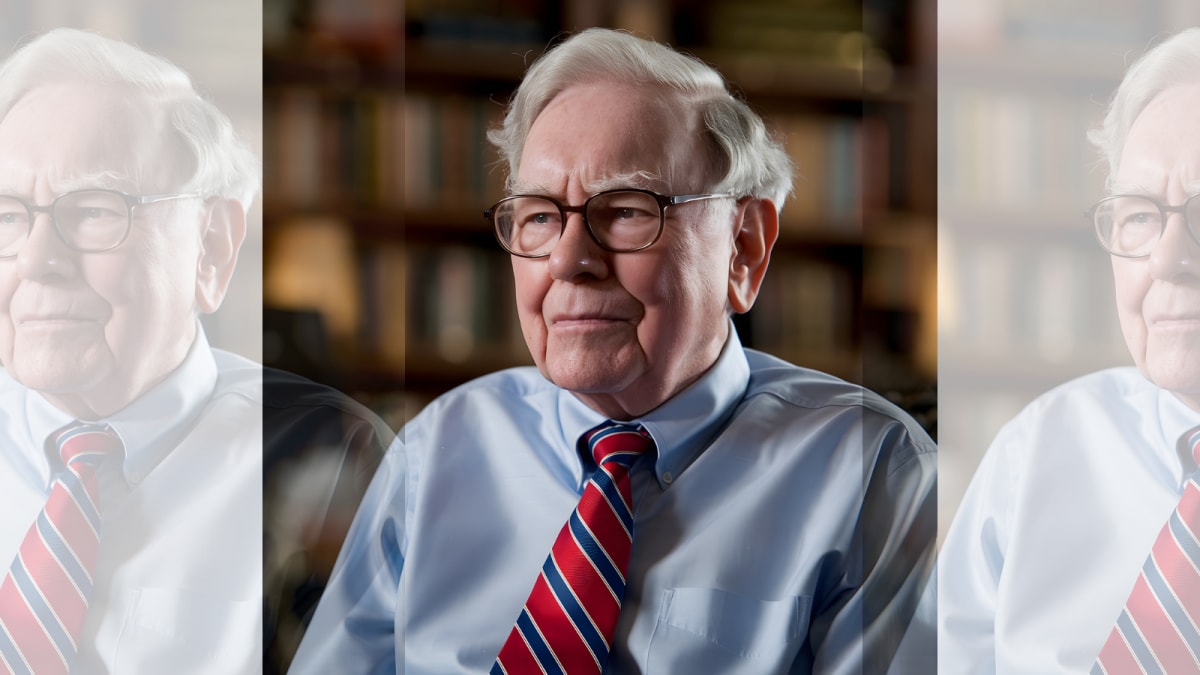

The announcement of Warren Buffett's impending retirement as CEO of Berkshire Hathaway by the end of 2025 has sent ripples throughout the global business community. Buffett, often hailed as the 'Oracle of Omaha,' has been a towering figure in the world of investing for decades, and his departure marks the end of an era. His leadership, investment acumen, and folksy wisdom have not only shaped Berkshire Hathaway into a diversified conglomerate worth hundreds of billions of dollars but have also influenced countless investors and business leaders worldwide. The selection of Greg Abel as his successor is a significant development, signaling a new chapter for the company. While Buffett's presence will undoubtedly be missed, the transition to Abel is viewed as a strategic move to ensure the continued success and stability of Berkshire Hathaway. The article captures the immediate reactions of prominent business figures, highlighting the profound impact Buffett has had on their careers and perspectives. Tim Cook, CEO of Apple, expressed his admiration for Buffett, emphasizing the inspiration he has drawn from his wisdom and acknowledging the privilege of knowing him. Cook also voiced confidence in Abel's ability to lead Berkshire Hathaway forward. Jim Cramer, a well-known television personality, lauded Buffett as the 'G.O.A.T.' (Greatest of All Time), underscoring his unparalleled achievements in the investment world. Mark Cuban, a billionaire entrepreneur, shared a video showcasing the enthusiastic ovation Buffett received upon announcing his retirement plans, reflecting the deep respect and appreciation he commands. The collective responses of these business leaders underscore Buffett's enduring legacy and the significant impact he has had on the global business landscape. The transition to Greg Abel represents both a challenge and an opportunity for Berkshire Hathaway. Abel, who currently oversees the company's non-insurance operations, has a proven track record and is well-regarded within the organization. However, stepping into the shoes of Warren Buffett is no easy task, as Buffett's unique personality, investment philosophy, and leadership style have been integral to the company's success. The challenge for Abel will be to maintain the core values and principles that have guided Berkshire Hathaway while also adapting to the evolving business environment and pursuing new opportunities for growth. The future of Berkshire Hathaway under Abel's leadership will be closely watched by investors and analysts alike. The company's diversified portfolio, which includes businesses in a wide range of industries, provides a solid foundation for continued success. However, the company will also need to navigate potential challenges such as changing consumer preferences, technological disruptions, and global economic uncertainties. Abel's strategic vision, operational expertise, and ability to foster a strong corporate culture will be critical to ensuring Berkshire Hathaway's long-term prosperity. Furthermore, the reactions from Tim Cook, Jim Cramer and Mark Cuban exemplify the universal impact Buffett has had on not only the investment world but the wider business landscape. His teachings, his style of leadership, and his general approach to viewing the world have made him a key figure and role model for many, making his retirement news a headline story. This article shows just how much of an influence he has been and how big of a void his retirement will leave. It also gives an insight into the potential future of Berkshire Hathaway as Greg Abel takes over as CEO, inheriting not only one of the most successful companies in the world but also a standard of excellence set by one of the most respected leaders of all time. The weight of expectation on Abel is immense, but his appointment is a clear indication of Buffett's trust and confidence in his abilities, promising an interesting new chapter for the company.

The announcement of Warren Buffett's retirement is more than just a changing of the guard at Berkshire Hathaway; it signifies a pivotal moment in the world of finance and business. Buffett's investment strategies, which emphasize long-term value investing, patience, and a deep understanding of the businesses he invests in, have become a benchmark for success. His ability to identify undervalued companies and hold them for the long term has generated immense wealth for Berkshire Hathaway's shareholders and solidified his reputation as one of the greatest investors of all time. Moreover, Buffett's ethical standards and commitment to integrity have earned him the respect of his peers and the public alike. He has consistently advocated for responsible corporate governance and has been a vocal critic of short-term thinking and excessive risk-taking in the financial industry. His emphasis on transparency and honesty has made him a trusted voice in a world often characterized by complexity and opacity. The reactions of business leaders like Tim Cook, Jim Cramer, and Mark Cuban reflect the widespread admiration for Buffett's principles and his unwavering commitment to doing what is right. As Greg Abel takes the helm, he will not only be tasked with maintaining the company's financial performance but also with upholding the ethical standards that Buffett has championed. This will require a strong commitment to corporate responsibility, a focus on long-term value creation, and a willingness to speak out against unethical behavior. The challenge for Abel will be to navigate the complexities of the modern business world while staying true to the principles that have guided Berkshire Hathaway for decades. The article also serves as a reminder of the importance of succession planning in organizations. Buffett's thoughtful approach to identifying and grooming his successor demonstrates the value of preparing for the future. By selecting Greg Abel and entrusting him with the leadership of Berkshire Hathaway, Buffett has ensured that the company will continue to thrive long after his departure. This is a lesson that other organizations can learn from, as effective succession planning is essential for ensuring the long-term sustainability of any business. In addition to his investment prowess and ethical standards, Buffett is also known for his folksy wisdom and his ability to communicate complex ideas in a simple and understandable way. His annual letters to shareholders are widely read and analyzed, as they provide valuable insights into his investment philosophy and his views on the economy and the business world. His quotes are often used by investors and business leaders to illustrate key principles and to inspire others to achieve success. Buffett's ability to connect with people on a personal level has made him a beloved figure, and his departure will be felt by many who have been inspired by his words and his example. The news of his retirement has prompted reflection on his legacy and the impact he has had on the world. As Berkshire Hathaway enters a new era under the leadership of Greg Abel, the company will undoubtedly continue to be guided by the principles that have made it one of the most successful and admired companies in the world. The transition to new leadership also creates opportunities for innovation and growth, as Abel brings his own unique perspective and experience to the role.

Furthermore, the impact of Warren Buffett's retirement extends beyond the immediate reactions of business leaders and the succession planning at Berkshire Hathaway. It prompts a broader reflection on the changing landscape of the investment world and the challenges faced by companies navigating an increasingly complex and uncertain global economy. Buffett's investment philosophy, which emphasizes long-term value investing and a deep understanding of the businesses he invests in, has become increasingly relevant in a world often characterized by short-term thinking and speculative investments. As technology continues to disrupt industries and markets become more volatile, the ability to identify undervalued companies with strong fundamentals and hold them for the long term becomes even more critical. Greg Abel, as the new CEO of Berkshire Hathaway, will need to navigate these challenges while maintaining the company's commitment to value investing. This will require a keen understanding of the evolving business environment, a willingness to adapt to new technologies, and the ability to identify emerging opportunities for growth. Moreover, Abel will need to foster a culture of innovation and collaboration within Berkshire Hathaway to ensure that the company remains competitive in the long term. The global economy also presents a number of challenges for Berkshire Hathaway, including rising inflation, supply chain disruptions, and geopolitical tensions. These factors can impact the performance of the company's diverse portfolio of businesses and require careful risk management. Abel will need to work closely with his team to monitor these risks and to develop strategies to mitigate their impact. In addition to these economic and geopolitical challenges, Berkshire Hathaway also faces increasing scrutiny from regulators and the public regarding its environmental, social, and governance (ESG) practices. As investors become more aware of the importance of sustainable investing, companies are being held to higher standards of accountability. Abel will need to ensure that Berkshire Hathaway is committed to responsible corporate citizenship and that it is transparent about its ESG performance. This will require a focus on reducing the company's environmental footprint, promoting social justice, and adhering to the highest standards of corporate governance. The transition to new leadership also creates an opportunity for Berkshire Hathaway to strengthen its commitment to diversity and inclusion. As the company continues to grow and expand its global operations, it will need to ensure that its workforce reflects the diversity of the communities it serves. Abel can play a key role in promoting diversity and inclusion within Berkshire Hathaway by creating a culture that values different perspectives and by providing opportunities for advancement for all employees. In conclusion, Warren Buffett's retirement marks a significant turning point for Berkshire Hathaway and the wider business world. As Greg Abel takes the helm, he will face a number of challenges and opportunities as he seeks to maintain the company's legacy of success. By staying true to the principles that have guided Berkshire Hathaway for decades, by embracing innovation, and by committing to responsible corporate citizenship, Abel can ensure that the company continues to thrive for many years to come. The reactions of business leaders to Buffett's retirement underscore the profound impact he has had on the world and serve as a reminder of the importance of ethical leadership and long-term value creation. The news from this article and the wider reaching influence of Buffett ensures his place in business history for years to come.

Source: 'Never Been Someone Like...': Biz Leaders React To Warren Buffett’s Retirement Plan