|

|

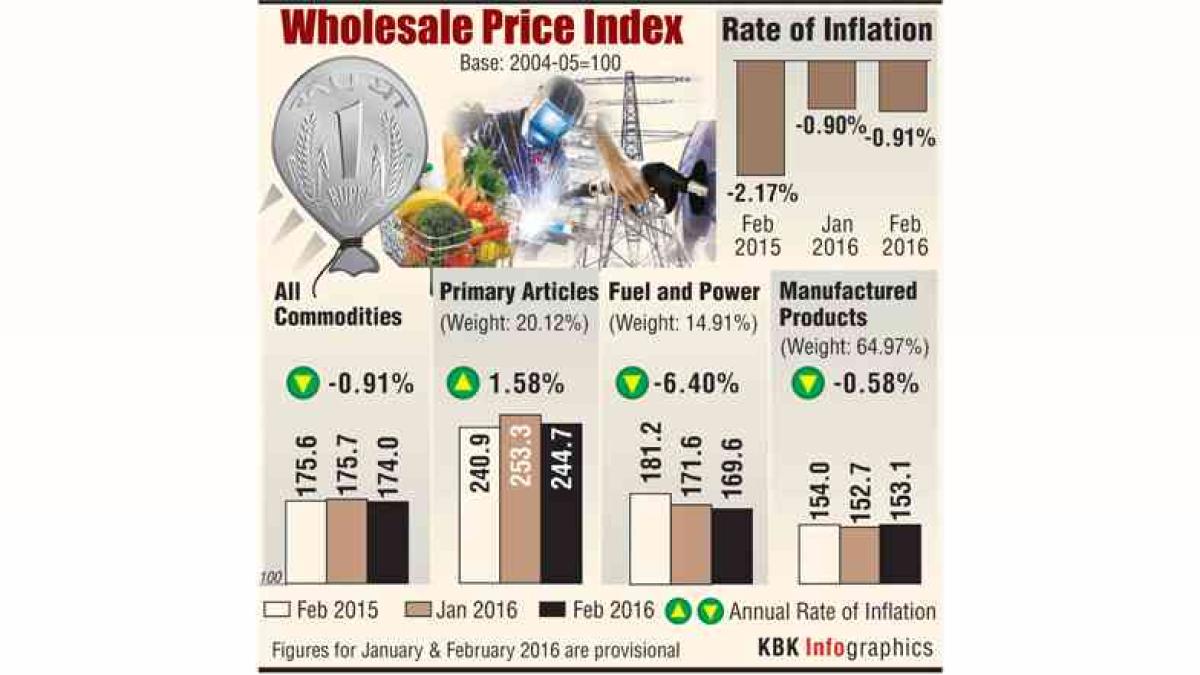

The recent announcement of India's Wholesale Price Index (WPI) inflation dipping to a 13-month low of 0.85% in April marks a significant development in the nation's economic landscape. This moderation in inflation, primarily driven by the softening of prices in critical sectors like food, fuel, and manufactured goods, offers a glimmer of hope amid ongoing economic uncertainties. Understanding the underlying factors contributing to this decline and its potential implications for the broader economy is crucial for policymakers, businesses, and consumers alike. The data, released by the government, reveals a notable contrast to the previous month, where WPI inflation stood at 2.05%, and even the corresponding period last year, which registered 1.19%. This substantial decrease underscores a shift in price dynamics across the wholesale market, warranting a closer examination of the forces at play. The Ministry of Industry attributed the positive rate of inflation, albeit at a lower level, to increases in the prices of manufactured food products, other manufacturing activities, chemicals and chemical products, transport equipment, and machinery. However, this positive impetus was offset by deflation in food and fuel & power, coupled with disinflation in manufactured products, ultimately leading to the overall moderation in WPI inflation. A deeper dive into the sectoral breakdown reveals interesting trends. Food articles, a crucial component of the WPI basket, experienced deflation of 0.86% in April, a stark contrast to the 1.57% inflation observed in March. This turnaround was largely influenced by a significant deflation in vegetables, which plummeted by 18.26% in April compared to 15.88% in March. The easing of inflation in key commodities like onions (0.20% in April vs. 26.65% in March) and fruits (8.38% in April vs. 20.78% in March) further contributed to the deflationary trend in the food sector. Conversely, certain food items like potatoes and pulses continued to experience deflation, registering rates of 24.30% and 5.57%, respectively. The fuel and power sector also played a significant role in the overall WPI moderation, with deflation of 2.18% in April, a sharp reversal from the 0.20% inflation recorded in March. This decline was primarily attributed to the sharp sequential decrease in prices of mineral oils such as kerosene, aviation turbine fuel (ATF), and motor fuels. The stability of crude oil prices, generally hovering in the USD 60-65/barrel range in April, coupled with downward pressure arising from OPEC+'s announcement of production increases, further contributed to the deflationary trend in this sector. While manufactured products experienced inflation at 2.62% in April, it was still lower than the 3.07% recorded in March, indicating a moderation in price pressures within the manufacturing sector. The Reserve Bank of India (RBI), the country's central bank, closely monitors WPI inflation, along with retail inflation (measured by the Consumer Price Index or CPI), to formulate its monetary policy. The recent easing of both WPI and CPI inflation provides the RBI with greater flexibility to implement further interest rate cuts to stimulate economic growth. In April, the RBI already reduced the benchmark policy rate by 0.25% to 6%, marking the second rate cut during the year. This proactive measure reflects the central bank's commitment to supporting the economy amid concerns about US reciprocal tariffs. The RBI projects retail inflation to average 4% in the current fiscal year, a downward revision from the previous estimate of 4.2%. The favorable base effects are expected to keep WPI inflation low in the coming months, according to Barclays. ICRA Senior Economist Rahul Agrawal anticipates the WPI to average below 2% in fiscal year 2026. This projection, combined with their CPI inflation and real GDP forecasts, suggests that nominal GDP growth may be capped at 9%. The India Meteorological Department's (IMD) forecast of an early monsoon onset in Kerala and an above-normal monsoon across the country is a positive sign for crop output and, consequently, the food inflation outlook. However, the spatial and temporal distribution of the monsoon rains remains a key factor in determining the overall impact on agricultural production and food prices. While the moderation in WPI inflation is a welcome development, it is essential to acknowledge the potential challenges and risks that lie ahead. Fluctuations in global commodity prices, particularly crude oil, can significantly impact WPI inflation, given India's heavy reliance on oil imports. Similarly, unforeseen disruptions in the supply chain, whether due to domestic factors or global events, can also lead to price volatility. Furthermore, the impact of government policies and regulations, such as changes in import duties or subsidies, can also influence WPI inflation. In conclusion, the recent decline in India's WPI inflation to a 13-month low is a positive sign, driven by softening prices in food, fuel, and manufactured goods. This moderation provides the RBI with greater flexibility to implement accommodative monetary policies to support economic growth. However, policymakers and businesses must remain vigilant and proactively address potential challenges and risks to ensure that the economy remains on a sustainable growth path.

Analyzing the components of the Wholesale Price Index (WPI) reveals nuanced insights into the Indian economy's inflationary trends. The WPI, a crucial indicator of price movements at the wholesale level, reflects the collective price changes of goods traded between businesses, before they reach the retail consumer. The recent dip in WPI inflation to a 13-month low is a result of interplay of various factors affecting different sectors of the economy. Examining these factors is vital for understanding the overall economic health and formulating appropriate policy responses. Food inflation, which has been a major concern in recent years, has shown a significant moderation in the latest WPI data. The deflation in food articles, particularly vegetables, is a welcome relief for consumers who have been grappling with high food prices. Several factors have contributed to this deflation, including improved agricultural production, favorable weather conditions, and government interventions to stabilize prices. However, it is important to note that the deflation in some food items like potatoes and pulses may be indicative of other issues such as oversupply or reduced demand. The fuel and power sector has also played a significant role in the overall WPI moderation. The deflation in this sector is largely attributed to the decline in global crude oil prices. India is a major importer of crude oil, and any fluctuation in global oil prices has a direct impact on domestic fuel prices. The stability of crude oil prices in recent months, coupled with the OPEC+ decision to increase production, has led to a decline in domestic fuel prices, thereby contributing to the WPI moderation. Manufactured products, which constitute a significant portion of the WPI basket, have shown a moderate increase in inflation. This increase is indicative of the overall economic activity and demand in the manufacturing sector. However, the moderation in manufactured product inflation suggests that price pressures in this sector are relatively contained. It is important to note that the WPI is not the only indicator of inflation in the Indian economy. The Consumer Price Index (CPI), which measures the change in prices of goods and services purchased by households, is another important indicator of inflation. The CPI is often considered to be a more accurate reflection of the inflation faced by consumers. The Reserve Bank of India (RBI) closely monitors both WPI and CPI inflation to formulate its monetary policy. The RBI's primary objective is to maintain price stability while supporting economic growth. The recent moderation in both WPI and CPI inflation has provided the RBI with greater flexibility to implement further interest rate cuts to stimulate economic growth. The RBI has already reduced the benchmark policy rate by 0.25% to 6% in April, and further rate cuts are likely if inflation remains under control. The government also plays a crucial role in managing inflation. The government can use fiscal policy measures, such as taxation and subsidies, to influence prices. For example, the government can reduce import duties on essential commodities to lower their prices. The government can also provide subsidies to farmers to encourage them to increase production. In addition to fiscal policy measures, the government can also use administrative measures to control inflation. For example, the government can impose price controls on essential commodities to prevent hoarding and profiteering. The moderation in WPI inflation is a positive development for the Indian economy. However, it is important to remain vigilant and monitor the underlying factors that are driving inflation. The government and the RBI need to work together to ensure that inflation remains under control while supporting sustainable economic growth. A stable and predictable inflation environment is essential for fostering investment, promoting consumption, and improving the overall standard of living.

The interplay between wholesale and retail inflation, as reflected in the WPI and CPI respectively, is a crucial aspect of understanding the Indian economy's price dynamics. While both indices measure inflation, they capture price movements at different stages of the supply chain, providing complementary perspectives on the overall inflationary pressures in the economy. The WPI, as previously discussed, tracks price changes at the wholesale level, reflecting the costs faced by businesses before goods reach consumers. The CPI, on the other hand, measures the average change in prices paid by urban consumers for a basket of goods and services, representing the inflation experienced directly by households. The relationship between WPI and CPI is complex and can be influenced by various factors, including transportation costs, retail markups, and government policies. Generally, changes in WPI tend to precede changes in CPI, as wholesale price increases or decreases eventually get passed on to consumers. However, the magnitude and timing of this pass-through can vary depending on the market conditions and the pricing power of retailers. In the current scenario, the moderation in WPI inflation is expected to eventually translate into lower CPI inflation, providing relief to consumers who have been grappling with high prices. The recent data already shows a decline in CPI inflation, driven by subdued prices of vegetables, fruits, pulses, and other protein-rich items. However, the pass-through from WPI to CPI is not always seamless, and there can be instances where CPI inflation remains elevated despite a decline in WPI inflation. This can happen if retailers choose to absorb some of the wholesale price reductions or if other factors, such as increased transportation costs or higher retail margins, offset the benefits of lower wholesale prices. The Reserve Bank of India (RBI) closely monitors both WPI and CPI inflation to formulate its monetary policy. The RBI's primary objective is to maintain price stability while supporting economic growth. The RBI's monetary policy actions, such as changes in interest rates, can influence both WPI and CPI inflation. For example, a reduction in interest rates can stimulate economic activity, leading to increased demand and potentially higher prices. Conversely, an increase in interest rates can curb economic activity, leading to reduced demand and potentially lower prices. The RBI typically focuses on CPI inflation as the primary indicator for monetary policy decisions, as it directly reflects the inflation experienced by consumers. However, the RBI also considers WPI inflation as an important leading indicator of future CPI inflation. The government also plays a crucial role in managing both WPI and CPI inflation. The government can use fiscal policy measures, such as taxation and subsidies, to influence prices. For example, the government can reduce excise duties on essential commodities to lower their prices. The government can also provide subsidies to farmers to encourage them to increase production, thereby increasing supply and potentially lowering prices. In addition to fiscal policy measures, the government can also use administrative measures to control inflation. For example, the government can impose stock limits on essential commodities to prevent hoarding and profiteering. The government can also take steps to improve the efficiency of the supply chain, such as reducing transportation costs and streamlining distribution channels, to lower prices. In conclusion, the relationship between WPI and CPI inflation is complex and multifaceted. While WPI inflation provides valuable insights into price movements at the wholesale level, CPI inflation reflects the inflation experienced directly by consumers. The RBI and the government need to work together to manage both WPI and CPI inflation to ensure price stability while supporting sustainable economic growth.